Ensemble Modeling in a Binary Classification Problem in Chinese A-Share Market

2017-11-15

In this research paper we try to use as much information on a stock as we can on Ricequant, to train a robust binary classifier for expected returns on a rolling basis. As an extra, we create a brand-new accuracy metric based on behavioral economics for model traing, which enhanced the fitting of the models (in the language of classical metrics, e.g. accuracy or pricision scores) by 3 to 5 times. The advantage of this new metric will be covered in the corresponding sector.

Section 1: Environment Preparation

First we import the necessary packages we’re going to use later.

%config InlineBackend.figure_format = 'retina'

import numpy as np

import pandas as pd

from scipy.special import logit

from datetime import datetime

from dateutil.relativedelta import relativedelta

from tech import technical

import warnings

warnings.filterwarnings('ignore')

import matplotlib.pyplot as plt

import seaborn as sns

from xgboost import XGBClassifier

from sklearn.decomposition import PCA, KernelPCA

from sklearn.cross_validation import KFold, cross_val_score

from sklearn.metrics import make_scorer, accuracy_score, precision_score, recall_score

from sklearn.grid_search import GridSearchCV

from sklearn.feature_selection import VarianceThreshold, RFE, SelectKBest, chi2

from sklearn.preprocessing import MinMaxScaler

from sklearn.pipeline import Pipeline, FeatureUnion

from sklearn.linear_model import LogisticRegression

from sklearn.discriminant_analysis import LinearDiscriminantAnalysis

from sklearn.neighbors import KNeighborsClassifier

from sklearn.tree import DecisionTreeClassifier

from sklearn.naive_bayes import GaussianNB

from sklearn.svm import SVC

from sklearn.ensemble import BaggingClassifier, ExtraTreesClassifier, GradientBoostingClassifier, VotingClassifier, RandomForestClassifier, AdaBoostClassifier

sns.set_style('whitegrid')

pd.set_option('display.max_columns', None) # display all columns

Global configurations.

pool = index_components('000050.XSHG')

window = 3 # use the past 6 months for training and testing

risk_preference = -0.2 # in the range of (-1,1) exclusive!

verbose = True # set to False when you don't want to waste time on plotting

Section 2: Data Preparation

Load the raw data and encapsulate into a Pandas panel.

today = datetime.today()

s = pool[11]

price_df = get_price(s,today-relativedelta(months=window+6),today-relativedelta(days=1),'1d',['open','close','high','low','volume'])

price_df['mkt'] = get_price('000300.XSHG',today-relativedelta(months=window+6),today-relativedelta(days=1),'1d',['close'])

X_ = pd.DataFrame(technical(price_df),index=price_df.index,columns=np.arange(78).astype('str')).ix[-window*20-1:,:]

Some further data investigation.

Unshifted data for training:

for f in range(17,78): X_.ix[:,f] = X_.ix[:,f].astype('category')

y_ = (price_df.ix[X_.index,'close'] > price_df.ix[X_.index,'open']).astype('int')

Shift the data so that they corresponds with

$$ y_i = \text{clf}(X_i). $$

X = X_.ix[:-1,:]

y = y_[1:]

print(X.shape)

print(y.shape)

print(y.value_counts())

(60, 78)

(60,)

1 32

0 28

dtype: int64

y.describe()

count 60.000000

mean 0.533333

std 0.503098

min 0.000000

25% 0.000000

50% 1.000000

75% 1.000000

max 1.000000

dtype: float64

X.describe(include=['number'])

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 60.000000 | 6.000000e+01 | 60.000000 | 60.000000 |

| mean | 0.976212 | 25.990400 | 25.656650 | 24.940308 | 22.879636 | 21.834747 | 20.977319 | 39.063571 | 35.434052 | 0.852667 | 67.581394 | 26.807436 | 25.990400 | 25.173364 | 1.039211e+09 | 0.723869 | 24.547501 |

| std | 0.015776 | 2.827868 | 2.770969 | 2.614787 | 1.668471 | 1.437906 | 1.220115 | 7.954479 | 7.286649 | 0.354867 | 7.811732 | 3.090838 | 2.827868 | 2.616494 | 1.263014e+08 | 0.168018 | 4.961348 |

| min | 0.948008 | 22.640000 | 22.085000 | 21.392000 | 20.650167 | 19.762876 | 19.285863 | 25.863478 | 26.096620 | 0.413193 | 54.834433 | 22.887871 | 22.640000 | 22.083778 | 8.750972e+08 | 0.527858 | 16.936824 |

| 25% | 0.965606 | 23.293000 | 23.043000 | 22.981875 | 21.499667 | 20.572173 | 19.949996 | 32.360567 | 27.708563 | 0.528046 | 61.687466 | 23.800034 | 23.293000 | 22.799033 | 9.242619e+08 | 0.578824 | 20.770453 |

| 50% | 0.974243 | 25.244000 | 24.591000 | 24.007250 | 22.387833 | 21.624111 | 20.712315 | 39.207117 | 34.467175 | 0.749777 | 66.749465 | 26.030462 | 25.244000 | 24.397322 | 1.038170e+09 | 0.656475 | 23.760415 |

| 75% | 0.987142 | 29.210500 | 28.633250 | 27.278500 | 24.174250 | 23.017472 | 21.933203 | 46.661330 | 41.646060 | 1.179799 | 73.758827 | 30.086332 | 29.210500 | 27.848188 | 1.159543e+09 | 0.852259 | 27.627880 |

| max | 1.007653 | 30.286000 | 29.820000 | 29.691500 | 26.243333 | 24.528111 | 23.411667 | 49.526365 | 46.601986 | 1.427553 | 82.767827 | 31.203224 | 30.286000 | 29.442553 | 1.301344e+09 | 1.065128 | 35.042981 |

X.describe(include=['category'])

| 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 | 71 | 72 | 73 | 74 | 75 | 76 | 77 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 |

| unique | 1.0 | 1.0 | 1.0 | 2.0 | 2.0 | 1.0 | 1.0 | 1.0 | 2.0 | 3.0 | 1.0 | 3.0 | 1.0 | 1.0 | 2.0 | 2.0 | 1.0 | 1.0 | 3.0 | 1.0 | 1.0 | 1.0 | 2.0 | 2.0 | 2.0 | 3.0 | 3.0 | 3.0 | 4.0 | 1.0 | 2.0 | 1.0 | 1.0 | 2.0 | 1.0 | 1.0 | 1.0 | 2.0 | 3.0 | 3.0 | 2.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 2.0 | 1.0 | 2.0 | 2.0 | 3.0 | 3.0 | 1.0 | 1.0 | 1.0 | 1.0 | 2.0 | 1.0 | 1.0 | 1.0 | 1.0 |

| top | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| freq | 60.0 | 60.0 | 60.0 | 59.0 | 57.0 | 60.0 | 60.0 | 60.0 | 59.0 | 47.0 | 60.0 | 55.0 | 60.0 | 60.0 | 59.0 | 51.0 | 60.0 | 60.0 | 53.0 | 60.0 | 60.0 | 60.0 | 59.0 | 59.0 | 59.0 | 55.0 | 58.0 | 49.0 | 51.0 | 60.0 | 59.0 | 60.0 | 60.0 | 59.0 | 60.0 | 60.0 | 60.0 | 51.0 | 48.0 | 57.0 | 57.0 | 60.0 | 60.0 | 60.0 | 60.0 | 60.0 | 55.0 | 60.0 | 59.0 | 59.0 | 51.0 | 41.0 | 60.0 | 60.0 | 60.0 | 60.0 | 59.0 | 60.0 | 60.0 | 60.0 | 60.0 |

unbalance = sum(y==1)/len(y)

if not (2/5 < unbalance < 3/5): print('Unbalanced dataset!!!')

unbalance

0.53333333333333333

data = X

data.loc[:,'y'] = y.values

data.columns

Index(['0', '1', '2', '3', '4', '5', '6', '7', '8', '9', '10', '11', '12',

'13', '14', '15', '16', '17', '18', '19', '20', '21', '22', '23', '24',

'25', '26', '27', '28', '29', '30', '31', '32', '33', '34', '35', '36',

'37', '38', '39', '40', '41', '42', '43', '44', '45', '46', '47', '48',

'49', '50', '51', '52', '53', '54', '55', '56', '57', '58', '59', '60',

'61', '62', '63', '64', '65', '66', '67', '68', '69', '70', '71', '72',

'73', '74', '75', '76', '77', 'y'],

dtype='object')

Quick look at the distribution of y.

if verbose:

ax = plt.axes()

sns.countplot(x='y', data=data, ax=ax)

ax.set_title('Actual y Distribution (total: {})'.format(len(data)))

plt.show()

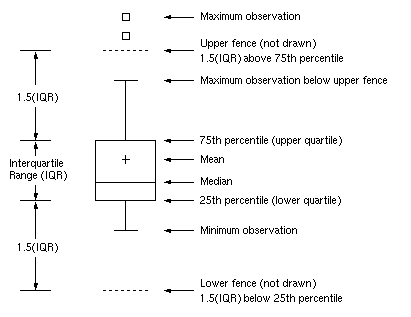

At first we can see that the target variable is distributed quite equally. We won’t perform any actions to deal with imbalanced dataset. First we present the continuous data using boxplot (described in the following image)

Boxplot of y against continuous variables.

if verbose:

f, axarr = plt.subplots(4, 4, figsize=(15, 15))

for i in range(16):

sns.boxplot(x=str(i), y='y', data=data, showmeans=True, ax=axarr[i//4,i%4])

axarr[i//4,i%4].set_title('factor '+str(i))

plt.tight_layout()

plt.show()

Pairplot of all continous variables.

if verbose:

sns.pairplot(data, vars=[str(i) for i in range(1,17)], hue='y', size=3)

plt.show()

Dummy encoding for categorical variables.

for i in range(17,78):

dummies = pd.get_dummies(data.ix[:,i])

dummies = dummies.add_prefix("{}#".format(i))

data.drop(str(i), axis=1, inplace=True)

data = data.join(dummies)

Section 3: Feature Selection

Drop columns that contains only one value.

mask = data.std() == 0

data_valid = data.ix[:,~mask]

X = data_valid.drop('y', axis=1)

y = data_valid['y']

print(X.columns.tolist())

['0', '1', '2', '3', '4', '5', '6', '7', '8', '9', '10', '11', '12', '13', '14', '15', '16', '19#0.0', '19#100.0', '21#-100.0', '21#0.0', '24#-100.0', '24#0.0', '26#-100.0', '26#0.0', '26#100.0', '28#0.0', '28#100.0', '29#-100.0', '29#0.0', '30#-100.0', '30#0.0', '30#100.0', '31#-200.0', '31#-100.0', '31#0.0', '31#100.0', '32#0.0', '32#100.0', '36#-100.0', '36#0.0', '36#100.0', '37#0.0', '37#100.0', '40#0.0', '40#100.0', '41#0.0', '41#100.0', '42#-100.0', '42#0.0', '42#100.0', '45#-100.0', '45#0.0', '49#0', '49#1', '51#0', '51#1', '53#0', '53#1', '54#0', '54#1', '55#0', '55#1', '56#0', '56#1', '57#0', '57#1', '58#0', '58#1', '59#0', '59#1', '60#0', '60#1', '61#0', '61#1', '62#0', '62#1', '64#0', '64#1', '65#0', '65#1', '66#0', '66#1', '68#0', '68#1', '69#0', '69#1', '70#0', '70#1', '72#0', '72#1', '75#0', '75#1', '76#0', '76#1']

Variance Ranking

vt = VarianceThreshold().fit(X)

ranks = (-vt.variances_).argsort().argsort()

feat_var_threshold = X.columns[ranks<=20]

print(feat_var_threshold.tolist())

['1', '2', '3', '4', '5', '6', '7', '8', '9', '10', '11', '12', '13', '14', '16', '31#0.0', '36#0.0', '42#0.0', '65#0', '70#0', '70#1']

Random Forest

model = RandomForestClassifier()

model.fit(X,y)

feature_imp = pd.DataFrame(model.feature_importances_, index=X.columns, columns=['importance'])

feat_imp_20 = feature_imp.sort_values('importance', ascending=False).head(20).index

print(feat_imp_20.tolist())

['16', '2', '13', '14', '9', '8', '0', '1', '15', '10', '7', '6', '68#0', '70#1', '4', '64#0', '11', '30#0.0', '3', '5']

Chi2 Test

X_minmax = MinMaxScaler([0,1]).fit_transform(X)

X_scored = SelectKBest(score_func=chi2, k='all').fit(X_minmax, y)

feature_scoring = pd.DataFrame({'feature': X.columns,'score': X_scored.scores_})

feat_scored_20 = feature_scoring.sort_values('score', ascending=False).head(20)['feature'].values

print(feat_scored_20.tolist())

['42#-100.0', '64#1', '36#-100.0', '70#0', '68#1', '40#100.0', '31#-100.0', '60#1', '76#1', '51#0', '30#100.0', '32#100.0', '24#-100.0', '21#-100.0', '53#0', '30#-100.0', '57#1', '58#1', '59#1', '62#1']

Recursive Feature Elimination (RFE)

with logistic regression model.

rfe = RFE(LogisticRegression(),20)

rfe.fit(X, y)

feature_rfe_scoring = pd.DataFrame({'feature': X.columns,'score': rfe.ranking_})

feat_rfe_20 = feature_rfe_scoring[feature_rfe_scoring['score'] == 1]['feature'].values

print(feat_rfe_20.tolist())

['1', '2', '3', '4', '5', '6', '7', '8', '10', '11', '12', '13', '14', '16', '36#0.0', '40#0.0', '42#0.0', '68#0', '70#0', '70#1']

Final selection of features

is the union of all previous sets.

features = np.hstack([feat_var_threshold,feat_imp_20,feat_scored_20,feat_rfe_20])

features = np.unique(features)

print('Final features ({} in total): {}'.format(len(features),', '.join(features)))

Final features (46 in total): 0, 1, 10, 11, 12, 13, 14, 15, 16, 2, 21#-100.0, 24#-100.0, 3, 30#-100.0, 30#0.0, 30#100.0, 31#-100.0, 31#0.0, 32#100.0, 36#-100.0, 36#0.0, 4, 40#0.0, 40#100.0, 42#-100.0, 42#0.0, 5, 51#0, 53#0, 57#1, 58#1, 59#1, 6, 60#1, 62#1, 64#0, 64#1, 65#0, 68#0, 68#1, 7, 70#0, 70#1, 76#1, 8, 9

Section 4: Model Training

1. Split the training and testing data (ratio: 3:1).

data_clean = data_valid.ix[:,features.tolist()+['y']]

tot_len = len(data_clean)

split_len = tot_len * 3 // 4

X_train = data_clean.ix[:split_len,features]

X_test = data_clean.ix[split_len:,features]

y_train = data_clean.ix[:split_len,'y']

y_test = data_clean.ix[split_len:,'y']

print('Clean dataset shape: {}'.format(data_clean.shape))

print('Train features shape: {}'.format(X_train.shape))

print('Test features shape: {}'.format(X_test.shape))

print('Train label shape: {}'. format(y_train.shape))

print('Test label shape: {}'. format(y_test.shape))

Clean dataset shape: (60, 47)

Train features shape: (45, 46)

Test features shape: (15, 46)

Train label shape: (45,)

Test label shape: (15,)

2. PCA visualization of training data

PCA plot

if verbose:

components = 8

pca = PCA(n_components=components).fit(X_train)

pca_variance_explained_df = pd.DataFrame({'component': np.arange(1, components+1),'variance_explained': pca.explained_variance_ratio_})

ax = sns.barplot(x='component', y='variance_explained', data=pca_variance_explained_df)

ax.set_title('PCA - Variance explained')

plt.show()

Lmplot

if verbose:

X_pca = pd.DataFrame(pca.transform(X_train)[:,:2])

X_pca['target'] = y_train.values

X_pca.columns = ["x", "y", "target"]

sns.lmplot('x','y',

data=X_pca,

hue="target",

fit_reg=False,

markers=["o", "x"],

palette="Set1",

size=7,

scatter_kws={"alpha": .2})

plt.show()

3. A New Accuracy Metric Based on Utility and Risk-Aversion

Instead of using existing accuracy or error metrics, e.g. accuracy scores and log loss, we tend to come up with our own metric that suits this scenario better. According to classical utility theory, the utility on the expected net return of a transaction should at least follow these properties:

- Higher expected returns means higher utility;

- Zero expected return means zero absolute utility;

- Marginal utility decreases with higher expected returns;

- The utility is robust of scaling.

Mathematically, therefore, we know a well-behaved utility function $U(x)$ has:

- A non-negative first-order derivative;

- A non-positive second-order derivative;

- A zero at

$x=0$.

However, since late 20th century, this setting of utility has been widely criticized and the voice was mainly from behavioral economics. This group of people managed a huge number of empirical experiments and showed how poor such utility models work when the variation of risk-aversion is considered. Risk-aversion was originally introduced to catch the aversion of a human against uncertainty. In classical economics, there are a range of measures to depict such aversion. One of the most famous is Arrow–Pratt measure of absolute risk-aversion (ARA), which is defined based on the utility function:

$$ ARA = -\frac{U^{\prime}(x)}{U^{\prime\prime}(x)}. $$

The Arrow-Pratt absolute risk-aversion is well successful not only because it catches the concavity of the utility, but also it can be expanded into many special cases, mainly w.r.t. different classical utility functions like exponential or hyperbolic absolute utility. However, it is not in line with common sense, pointed by Daniel Kahneman and Amos Tversky in their prospect theory in 1972. The theory has been well further developed since 1992 and is now accepted as a more realistic model for uncertainty perception psychologically.

Different from the classical expected utility theory, the prospect theory specifies the utility in the following four implications:

- Certainty effect: most people are risk-averse about gaining;

- Reflection effect: most people are risk-loving about losing;

- Loss aversion: most people are more sensitive to losses than to gains;

- Reference dependence: most people’s perception of uncertainty is based on the reference point.

Considering here the notion of “most people” is typically based on the fact tha most investors are more or less risk-averse, we simplify the model by giving assumptions as follows:

- The first-order derivative of the utility is non-negative for all outcome;

- For risk-averse investors, the second-order derivative of the utility is non-negative for losses while non-positive for gains;

- For risk-loving investors, the second-order derivative of the utility is non-positive for losses while non-negative for gains;

- For risk-neutral investors, the second-order derivative is zero everywhere

while for the loss aversion implication, we don’t take it into consideration as the influence turned out to be minuscule compared with the loss of model simplicity.

Therefore, with the previous four assumptions, we can easily come up with a nice utility function w.r.t. prediction accuracy:

$$ U(x) = sgn(x-1/2)|2x-1|^{2^{logit\left(\frac{r+1}{2}\right)}} $$

where $sgn(\cdot)$ is the sign function and $logit(\cdot)$ is the logit function, which is also known as the inverse of the sigmoidal “logistic” function:

$$ logit(x)=\ln\left(\frac{x}{1-x}\right). $$

It is easy to validate that our utility follows the configuration and because of its monotonicity and continuity in $[0,1]$, is a well-behaved accuracy metric for further learning algorithms.

Utility Curve

f = lambda x, r: (2*(x>0.5)-1)*abs(2*x-1)**(2**logit((r+1)/2))

if verbose:

colors = ['red','orange','yellow','lime','cyan']

r_grid = [-0.9,-0.5,0,0.5,0.9]

x_grid = np.linspace(0,1,100)

fig, ax = plt.subplots(figsize=(5,5))

for i in range(len(r_grid)):

f_grid = [f(x,r_grid[i]) for x in x_grid]

ax.plot(x_grid, f_grid,c=colors[i],label='r = {:> 3.1f}'.format(r_grid[i]))

ax.plot((0,1),(0,0),c='black')

box = ax.get_position()

ax.set_position([box.x0, box.y0, box.width * 0.8, box.height])

ax.legend(loc='center left', bbox_to_anchor=(1, 0.5))

ax.set_ylim([-1,1])

ax.set_xlim([0,1])

plt.xlabel('Accuracy')

plt.ylabel('Utility')

plt.title('Utility Curve for Different Risk Preferences')

plt.show()

def custom_score(y_true, y_pred):

x = sum(y_pred == y_true) / len(y_true)

r = risk_preference

return f(x,r)

seed = 7

processors = 1

num_folds = 4

num_instances = len(X_train)

scoring = make_scorer(custom_score)

kfold = KFold(n=num_instances, n_folds=num_folds, random_state=seed)

First let’s have a quick spot-check.

# Some basic models

models = []

models.append(('LR', LogisticRegression()))

models.append(('LDA', LinearDiscriminantAnalysis()))

models.append(('KNN', KNeighborsClassifier(n_neighbors=5)))

models.append(('DT', DecisionTreeClassifier()))

models.append(('GNB', GaussianNB()))

models.append(('SVC', SVC(probability=True, class_weight='balanced')))

# Evaluate each model in turn

results = []

names = []

for name, model in models:

cv_results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring, n_jobs=processors)

results.append(cv_results)

names.append(name)

print("{}: ({:.3f}) +/- ({:.3f})".format(name, cv_results.mean(), cv_results.std()))

LR: (0.117) +/- (0.436)

LDA: (0.518) +/- (0.163)

KNN: (0.255) +/- (0.263)

DT: (0.255) +/- (0.263)

GNB: (-0.106) +/- (0.393)

SVC: (0.117) +/- (0.436)

Let’s first look at ensemble results.

Section 5: Ensemble Modeling and Validation

1. Bagging (Bootstrap Aggregation)

Prediction of a bagging model is the average of all sub-models.

Bagged Decision Trees

Bagged Desicion Trees performs the best when the variance is large in the dataset.

cart = DecisionTreeClassifier()

num_trees = 100

model = BaggingClassifier(base_estimator=cart, n_estimators=num_trees, random_state=seed)

results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring, n_jobs=processors)

print("({:.3f}) +/- ({:.3f})".format(results.mean(), results.std()))

(0.158) +/- (0.312)

Random Forest

Random forest is a famous extension to bagged decision trees. It is usually more precise but slower, especially for large number of leaves.

num_trees = 100

num_features = 10

model = RandomForestClassifier(n_estimators=num_trees, max_features=num_features)

results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring, n_jobs=processors)

print("({:.3f}) +/- ({:.3f})".format(results.mean(), results.std()))

(-0.082) +/- (0.295)

Extra Trees

Randomness is introduced to investigate further precision.

num_trees = 100

num_features = 10

model = ExtraTreesClassifier(n_estimators=num_trees, max_features=num_features)

results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring, n_jobs=processors)

print("({:.3f}) +/- ({:.3f})".format(results.mean(), results.std()))

(0.015) +/- (0.484)

2. Boosting Boosting ensembles a sequence of weak learners for better performance.

AdaBoost

AdaBoost simply gives the weighted average of results by a series of weak learners, with updating the weight vector in each iteration.

model = AdaBoostClassifier(n_estimators=100, random_state=seed)

results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring, n_jobs=processors)

print("({:.3f}) +/- ({:.3f})".format(results.mean(), results.std()))

(0.291) +/- (0.387)

Stochastic Gradient Boosting

Gradient Tree Boosting or Gradient Boosted Regression Trees (GBRT) is a generalization of boosting. It uses arbitrary differentiable loss functions so that is more accurate and effective.

model = GradientBoostingClassifier(n_estimators=100, random_state=seed)

results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring, n_jobs=processors)

print("({:.3f}) +/- ({:.3f})".format(results.mean(), results.std()))

(0.291) +/- (0.387)

Extreme Gradient Boosting

A (usually) more efficient gradient boosting algorithm by Tianqi Chen.

model = XGBClassifier(n_estimators=100, seed=seed)

results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring, n_jobs=processors)

print("({:.3f}) +/- ({:.3f})".format(results.mean(), results.std()))

(0.189) +/- (0.459)

3. Hyperparameter tuning

As a matter of fact, hyperparameter tuning can matter a lot here, and thus to actual determine which models are the best, we need to run grid searching and cross validation of the training dataset for the best scores and the model configurations corresponing to them.

estimator_list = []

estimator_name_list = []

best_score_list = []

best_params_list = []

Logistic Regression

lr_grid = GridSearchCV(estimator = LogisticRegression(random_state=seed),

param_grid = {'penalty': ['l1', 'l2'],

'C': [1e-3, 1e-2, 1, 10, 100, 1000]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

lr_grid.fit(X_train, y_train)

print(lr_grid.best_score_)

print(lr_grid.best_params_)

estimator_name_list.append('LR')

estimator_list.append(LogisticRegression)

best_score_list.append(lr_grid.best_score_)

best_params_list.append(lr_grid.best_params_)

0.3726887283268559

{'penalty': 'l1', 'C': 1}

Linear Discriminant Analysis

lda_grid = GridSearchCV(estimator = LinearDiscriminantAnalysis(),

param_grid = {'solver': ['svd','lsqr'],

'n_components': [None, 2, 5, 10, 20]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

lda_grid.fit(X_train, y_train)

print(lda_grid.best_score_)

print(lda_grid.best_params_)

estimator_name_list.append('LDA')

estimator_list.append(LinearDiscriminantAnalysis)

best_score_list.append(lda_grid.best_score_)

best_params_list.append(lda_grid.best_params_)

0.5622889460982887

{'n_components': None, 'solver': 'svd'}

Decision Tree

dt_grid = GridSearchCV(estimator = DecisionTreeClassifier(random_state=seed),

param_grid = {'criterion': ['gini','entropy'],

'max_depth': [None, 2, 5, 10],

'max_features': [None,'auto',20]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

dt_grid.fit(X_train, y_train)

print(dt_grid.best_score_)

print(dt_grid.best_params_)

estimator_name_list.append('DT')

estimator_list.append(DecisionTreeClassifier)

best_score_list.append(dt_grid.best_score_)

best_params_list.append(dt_grid.best_params_)

0.34852862485121184

{'criterion': 'gini', 'max_depth': None, 'max_features': None}

K-Nearest Neighbors

knn_grid = GridSearchCV(estimator = KNeighborsClassifier(),

param_grid = {'n_neighbors': [5, 10, 25],

'algorithm': ['ball_tree'],

'leaf_size': [2, 3, 5],

'p': [1]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

knn_grid.fit(X_train, y_train)

print(knn_grid.best_score_)

print(knn_grid.best_params_)

estimator_name_list.append('KNN')

estimator_list.append(KNeighborsClassifier)

best_score_list.append(knn_grid.best_score_)

best_params_list.append(knn_grid.best_params_)

0.30539557863515217

{'leaf_size': 2, 'algorithm': 'ball_tree', 'n_neighbors': 5, 'p': 1}

Random Forest

rf_grid = GridSearchCV(estimator = RandomForestClassifier(warm_start=True, random_state=seed),

param_grid = {'n_estimators': [100, 200],

'criterion': ['gini','entropy'],

'max_features': [None, 20],

'max_depth': [3, 5, 10],

'bootstrap': [True]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

rf_grid.fit(X_train, y_train)

print(rf_grid.best_score_)

print(rf_grid.best_params_)

estimator_name_list.append('RF')

estimator_list.append(RandomForestClassifier)

best_score_list.append(rf_grid.best_score_)

best_params_list.append(rf_grid.best_params_)

0.30113313283861066

{'bootstrap': True, 'max_depth': 5, 'n_estimators': 100, 'max_features': None, 'criterion': 'entropy'}

Extra Trees

ext_grid = GridSearchCV(estimator = ExtraTreesClassifier(warm_start=True, random_state=seed),

param_grid = {'n_estimators': [100, 200],

'criterion': ['gini', 'entropy'],

'max_features': [None, 20],

'max_depth': [3, 5, 10],

'bootstrap': [True]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

ext_grid.fit(X_train, y_train)

print(ext_grid.best_score_)

print(ext_grid.best_params_)

estimator_name_list.append('EXT')

estimator_list.append(ExtraTreesClassifier)

best_score_list.append(ext_grid.best_score_)

best_params_list.append(ext_grid.best_params_)

0.2601389681995039

{'bootstrap': True, 'max_depth': 10, 'n_estimators': 100, 'max_features': 20, 'criterion': 'entropy'}

AdaBoost

ada_grid = GridSearchCV(estimator = AdaBoostClassifier(random_state=seed),

param_grid = {'algorithm': ['SAMME', 'SAMME.R'],

'n_estimators': [100, 200],

'learning_rate': [1e-2, 1e-1]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

ada_grid.fit(X_train, y_train)

print(ada_grid.best_score_)

print(ada_grid.best_params_)

estimator_name_list.append('ADA')

estimator_list.append(AdaBoostClassifier)

best_score_list.append(ada_grid.best_score_)

best_params_list.append(ada_grid.best_params_)

0.30113313283861066

{'n_estimators': 200, 'algorithm': 'SAMME', 'learning_rate': 0.1}

Gradient Boosting

gbm_grid = GridSearchCV(estimator = GradientBoostingClassifier(warm_start=True, random_state=seed),

param_grid = {'n_estimators': [100, 200],

'max_depth': [3, 5, 10],

'max_features': [None, 20],

'learning_rate': [1e-2, 1e-1]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

gbm_grid.fit(X_train, y_train)

print(gbm_grid.best_score_)

print(gbm_grid.best_params_)

estimator_name_list.append('GBM')

estimator_list.append(GradientBoostingClassifier)

best_score_list.append(gbm_grid.best_score_)

best_params_list.append(gbm_grid.best_params_)

0.4376019643046027

{'n_estimators': 100, 'max_depth': 3, 'learning_rate': 0.01, 'max_features': None}

Extreme Gradient Boosting

xgb_grid = GridSearchCV(estimator = XGBClassifier(nthread=1, seed=seed),

param_grid = {'n_estimators': [100, 200],

'max_depth': [3, 5, 10],

'min_child_weight': [1, 5],

'gamma': [0, 0.1, 1, 10],

'learning_rate': [1e-2, 1e-1]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

xgb_grid.fit(X_train, y_train)

print(xgb_grid.best_score_)

print(xgb_grid.best_params_)

estimator_name_list.append('XGB')

estimator_list.append(XGBClassifier)

best_score_list.append(xgb_grid.best_score_)

best_params_list.append(xgb_grid.best_params_)

0.556562176665963

{'gamma': 0, 'min_child_weight': 1, 'max_depth': 5, 'learning_rate': 0.01, 'n_estimators': 200}

Support Vector Classification

svc_grid = GridSearchCV(estimator = SVC(probability=True, class_weight='balanced'),

param_grid = {'C': [1e-3, 1e-2, 1e-1, 1, 10],

'gamma': [1e-2, 1e-1, 1]},

cv = kfold,

scoring = scoring,

n_jobs = processors)

svc_grid.fit(X_train, y_train)

print(svc_grid.best_score_)

print(svc_grid.best_params_)

estimator_name_list.append('SVC')

estimator_list.append(SVC)

best_score_list.append(svc_grid.best_score_)

best_params_list.append(svc_grid.best_params_)

0.3422932503617775

{'gamma': 0.01, 'C': 0.1}

4. Voting ensemble

best_score_list_rounded = [round(s,3) for s in best_score_list]

seq = sorted(best_score_list, reverse=True)

rank = [seq.index(s) for s in best_score_list]

res = pd.DataFrame({'model':estimator_name_list,

'score':best_score_list_rounded,

'rank':rank},columns=['model','score','rank']).set_index('model')

res['rank'] = res['rank'].astype('object')

res.T

| model | LR | LDA | DT | KNN | RF | EXT | ADA | GBM | XGB | SVC |

|---|---|---|---|---|---|---|---|---|---|---|

| score | 0.373 | 0.562 | 0.349 | 0.305 | 0.301 | 0.26 | 0.301 | 0.438 | 0.557 | 0.342 |

| rank | 3 | 0 | 4 | 6 | 7 | 9 | 7 | 2 | 1 | 5 |

# Create sub models

estimators = []

# Choose models with larger logloss scores

for i in range(10): # in total 10 models

if rank[i] < 5: # if in top 5

estimators.append((estimator_name_list[i], estimator_list[i](**best_params_list[i])))

# Create the ensemble model

ensemble = VotingClassifier(estimators, voting='hard')

results = cross_val_score(ensemble, X_train, y_train, cv=kfold, scoring=scoring,n_jobs=processors)

print("({:.3f}) +/- ({:.3f})".format(results.mean(), results.std()))

(0.516) +/- (0.200)

It is clear that the ensemble model further enhanced the performance of the seperate models. Now we try to make actual predictions and see if the results are robust.

5. Make predictions

model = ensemble

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

print('Unbalance of the data: {:.3f}'.format(unbalance))

Unbalance of the data: 0.533

Now apart from the utility, we can check our prediction based on some other metrics, e.g.:

Accuracy

which is defined by

and should be bounded within $[0,1]$, where $1$ indicates perfect prediction. This is also called total accuracy, and it calculates the percentage of a right guess.

ac = accuracy_score(y_test, y_pred)

print('Accuracy: {:.3f}'.format(ac)) # (TP+TN) / (TP+FP+TN+FN)

Accuracy: 0.667

Precision

which is defined by

Similar as accuracy, this is also bounded and indicates perfect prediction when the value is 1. However, precision gives intuition about the percentage of correct guesses among all your guesses, so in this case the probability that your actual transaction is in the right direction.

pc = precision_score(y_test, y_pred)

print('Precision: {:.3f}'.format(pc)) # TP / (TP+FP)

Precision: 0.818

Recall

which is defined by

Recall is also bounded and indicates perfect prediction when it’s 1, but different from precision, it gives intuition about the percentage of actual signals being predicted, i.e. in this case, the probability that you catch an actual appreciation.

re = recall_score(y_test, y_pred)

print('Recall: {:.3f}'.format(re)) # TP / (TP+FN)

Recall: 0.750

Although not included in this notebook, we think it is very important and encouraging to mention what these scores mean, compared with when other scoring functions are used in grid searching. As a matter of fact, the average accuracy given by the ensemble model using accuracy or log loss directly is much lower than these figures above. In general, the model prediction accuracy has been improved from 15% - 25% to 60% - 80%, i.e. 2 to 5 times. The effect of introducing this utility-like scoring function for hyperparameter tuning is substantial, though needs further theoretical proofs, of course.

Lastly, let’s check this utility value for the testing dataset.

cs = custom_score(y_test, y_pred)

print('Utility: {:.3f}'.format(cs))

Utility: 0.287

which is thus robust (even higher, in fact) out of sample.

Conclusion and Prospective Improvements

The ensemble model I’ve just shown above is quite naive, I would say, and is far from “good”. The metric is more or less still quite arbitrary and the algorithm is rather slow (so I set window length to 3 from 60 at first, which was intended to train a model on data of 5 years), and thus on an unprofessional platform like Ricequant we’re not allowed to run through the whole market and search for a best portfolio – the most predictable ones. In the backtest strategy I implimented based on this research paper, I only chose 5 stocks arbitrarily from the index components of 000050.XSHG, and this can have an unpredictable downside effect on the model performance. A more desirable idea would be to set up a local backtest environment and implement this process with the help of GPU and faster languages like C++. Moreover, overfitting is possible, very possible, and thus whether it will make a good strategy needs much more work of validation.

References

- Arrow, K. J. (1965). “Aspects of the Theory of Risk Bearing”. The Theory of Risk Aversion. Helsinki: Yrjo Jahnssonin Saatio. Reprinted in: Essays in the Theory of Risk Bearing, Markham Publ. Co., Chicago, 1971, 90–109.

- Pratt, J. W. (1964). “Risk Aversion in the Small and in the Large”. Econometrica. 32 (1–2): 122–136.

- Kahneman, Daniel; Tversky, Amos (1979). “Prospect theory: An analysis of decision under risk”. Econometrica: Journal of the econometric society. 47 (2): 263–291.

- Chen, T., & Guestrin, C. (2016). “Xgboost: A scalable tree boosting system”. In Proceedings of the 22nd acm sigkdd international conference on knowledge discovery and data mining (pp. 785-794). ACM.