Cryptocurrency Arbitrage (3): One More Strategy

2018-07-27

It’s been months since my last update on cryptocurrency arbitrage strategies. The original version has been completely driven off the market and thus I decided to develop a new one. The market is primitive and savage in many senses, by which I mean there’re supposed to be a bunch of inefficiency and corresponding arbitrage opportunities.

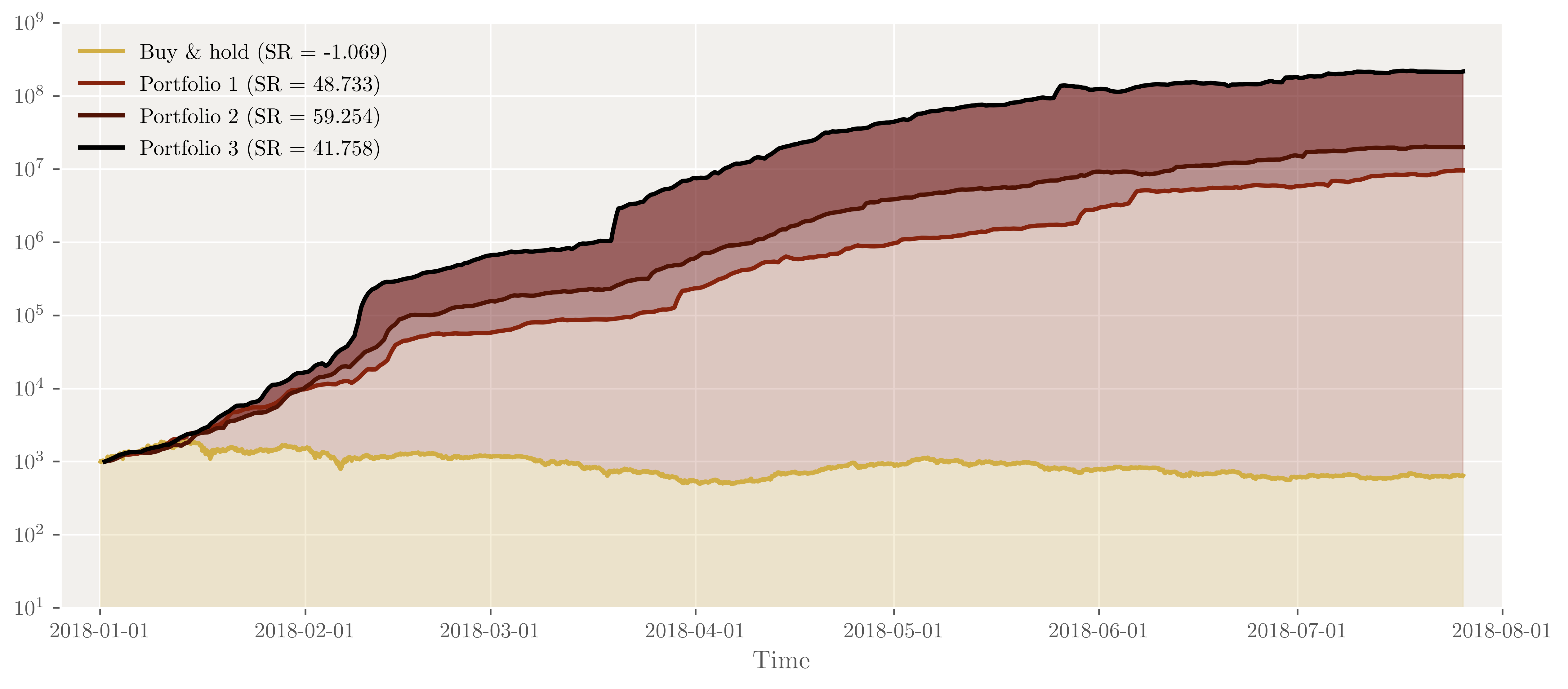

On the top of the page is the backtest PnL of the new strategy 4 from Jan 1 up to yesterday, July 26. I used 1 minute historical orderbook data, 5 spreads for slippage (not sure if it’s still too conservative, need testing) and benchmarked the simplest buy-and-hold strategy. It’s known that the whole crypto market has experienced a huge slump since late last year, so I guess my trick works quite well. The strategy is now running on my AWS in real money and I’ll update this post whenever any interesting (or frustrating) issue happens.

Cheers.

Update Aug 3:

I changed the screening window length and the performance (of backtest) increased over tenfold. The image on the top has been updated with Sharpe ratios labelled.