Bitcoin Inter-exchange Price Spread Prediction

2017-05-21

Price prediction is thought to be very difficult for any equity, however the price spread between two exchanges may not. We look into the price spread between two of the largest Bitcoin exchanges: Bitstamp and BTC-E.

Step 1: Import All Packages

import quandl

import cmocean

import warnings

import numpy as np

import pandas as pd

import seaborn as sns

import statsmodels.api as sm

from pytrends.request import TrendReq

from scipy import stats as ss

from datetime import datetime as dt

from arch.unitroot import PhillipsPerron, ADF

from matplotlib import pyplot as plt

from matplotlib import dates as mdates

from statsmodels.graphics.api import qqplot

pytrend = TrendReq('[email protected]', 'aaaaaaaaaa', hl='en-US', tz=360, custom_useragent=None)

warnings.filterwarnings('ignore')

quandl.ApiConfig.api_key = 'aaaaaaaaaaaaaaa'

pd.set_option("display.width",999)

plt.rcdefaults()

plt.style.use('seaborn-paper')

plt.rcParams['axes.facecolor']='w'

plt.rcParams['axes.grid']=False

plt.rcParams['font.family'] = 'serif'

plt.rcParams['figure.figsize'] = [12, 4]

Step 2: Data Retrieving and Cleaning

Data source: https://www.quandl.com/data/.

exchangelist = [

'BTCE',

'KRAKEN',

'BITFINEX',

'BITSTAMP',

# 'COINBASE',

'ROCK',

'HITBTC',

'ITBIT',

'BITBAY',

'BITKONAN',

'CBX',

'VCX'

]

n = len(exchangelist)

print('there are {} exchanges in total'.format(n))

there are 11 exchanges in total

exchanges = [quandl.get('BCHARTS/' + e + 'USD') for e in exchangelist]

for i in range(n):

daterange = exchanges[i].index.tolist()

print('{:>8}'.format(exchangelist[i]), daterange[0].date(), daterange[-1].date())

BTCE 2011-08-14 2017-05-19

KRAKEN 2014-01-07 2017-05-19

BITFINEX 2013-03-31 2016-12-22

BITSTAMP 2011-09-13 2017-05-19

ROCK 2011-11-12 2017-05-19

HITBTC 2013-12-27 2017-05-19

ITBIT 2013-08-25 2017-05-19

BITBAY 2014-05-16 2017-05-19

BITKONAN 2013-07-02 2017-05-19

CBX 2011-07-05 2017-04-16

VCX 2011-12-25 2017-05-19

start_date = pd.to_datetime('2014-07-01')

mid_date = pd.to_datetime('2016-01-01')

end_date = pd.to_datetime('2016-07-01')

price = pd.concat([e.ix[start_date:end_date,'Close'] for e in exchanges], join='outer', axis=1)

volume = pd.concat([e.ix[start_date:end_date,'Volume (Currency)'] for e in exchanges], join='outer', axis=1)

price.columns = exchangelist

volume.columns = exchangelist

price = price[price > 0].fillna(method='ffill').fillna(method='bfill')

volume = price[volume > 0].fillna(method='ffill').fillna(method='bfill')

print(price.describe())

BTCE KRAKEN BITFINEX BITSTAMP ROCK HITBTC ITBIT BITBAY BITKONAN CBX VCX

count 732.000000 732.000000 732.000000 732.000000 732.000000 732.000000 732.000000 732.000000 732.000000 732.000000 732.000000

mean 359.045682 363.799398 363.647027 363.204795 363.963907 373.581913 362.888860 367.052036 369.847240 367.836366 388.325161

std 119.611681 122.473245 122.182031 122.020091 121.643524 115.354405 121.729241 125.084653 123.984738 119.057448 94.745641

min 170.000000 175.000000 182.000000 171.410000 185.000000 186.760000 183.160000 186.890000 171.030000 200.040000 210.000001

25% 245.123250 249.669390 249.235000 249.047500 249.887500 272.900000 249.252500 253.750000 254.972500 254.757500 312.249915

50% 349.933000 358.429990 353.825000 356.495000 355.015000 357.610000 353.475000 359.995000 360.765000 365.005000 380.000000

75% 429.812500 430.136262 433.410000 432.535000 433.282500 438.695000 432.302500 435.082500 442.192500 432.992500 425.000000

max 729.855000 765.490000 769.500000 766.620000 767.800000 768.590000 767.180000 999.000000 771.670000 690.000000 658.000000

Step 3: Data Analysis

%config InlineBackend.figure_format = 'retina'

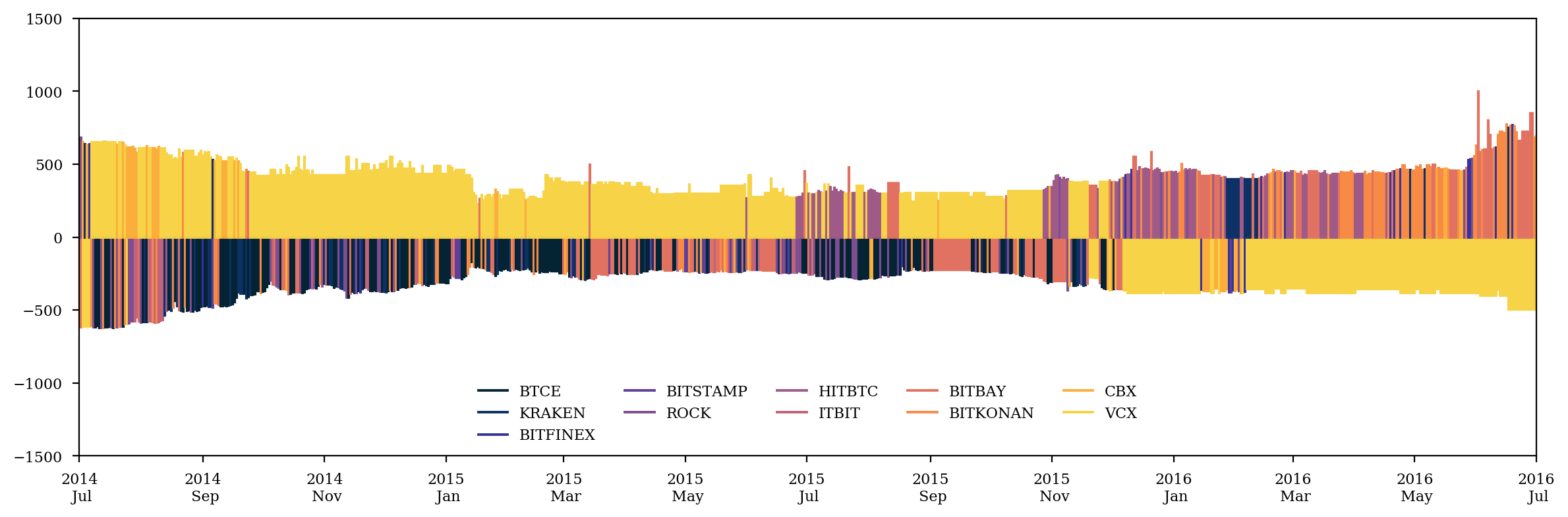

min_exchange = pd.Series([np.argmin(price.iloc[i], axis=0) for i in range(len(price))],

index=price.index).apply(lambda fn: exchangelist.index(fn))

max_exchange = pd.Series([np.argmax(price.iloc[i], axis=0) for i in range(len(price))],

index=price.index).apply(lambda fn: exchangelist.index(fn))

dmin = price.min(axis=1)

dmax = price.max(axis=1)

thermal = cmocean.cm.thermal

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

for i in range(n):

ax.plot((price.index[0], price.index[0]), (0, 0), c=thermal(i/n), label=exchangelist[i])

for i in range(len(price)):

ax.plot((price.index[i], price.index[i]), (0, -dmin[i]), lw=1.5, c=thermal(min_exchange[i]/n))

ax.plot((price.index[i], price.index[i]), (0, dmax[i]), lw=1.5, c=thermal(max_exchange[i]/n))

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(start_date, end_date)

ax.set_ylim(-1500,1500)

plt.legend(loc='lower center', frameon=0, ncol=n//2)

plt.tight_layout()

plt.savefig('price1.pdf')

plt.show()

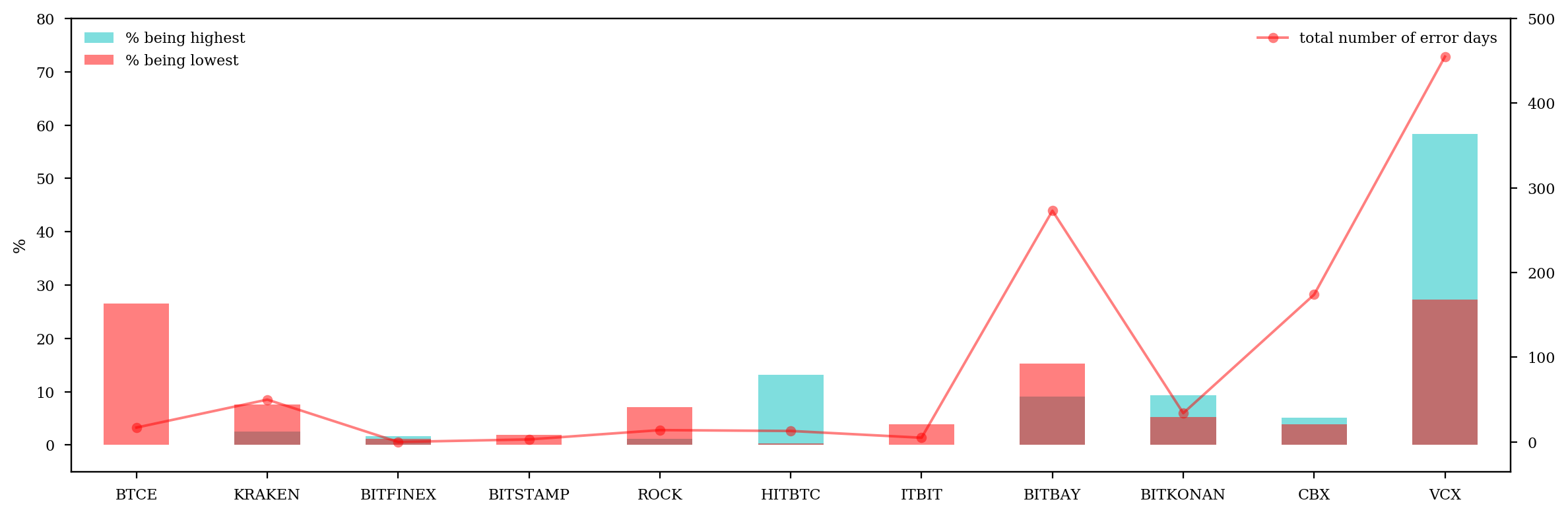

active_price = price * (price.diff() != 0)

active_price = active_price[active_price > 0]

err_count = np.isnan(active_price).sum()

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax1 = fig.add_subplot(111)

(100*max_exchange.value_counts().sort_index().reindex(range(len(exchangelist))).fillna(0)/len(price)).plot.bar(ax=ax1, color='c', align='center', alpha=.5, label='% being highest')

(100*min_exchange.value_counts().sort_index().reindex(range(len(exchangelist))).fillna(0)/len(price)).plot.bar(ax=ax1, color='r', align='center', alpha=.5, label='% being lowest')

ax1.set_ylim(-5,80)

ax1.set_ylabel('%')

plt.xticks(range(len(err_count)), err_count.index.tolist(), rotation=0)

ax1.legend(loc='upper left', frameon=0)

ax2 = ax1.twinx()

err_count.plot(ax=ax2, marker='o', color='r', alpha=.5, label='total number of error days')

ax2.set_xlim(-.5,len(err_count)-.5)

ax2.set_xticks(range(len(err_count)), err_count.index.tolist())

ax2.legend(loc='upper right', frameon=0)

ax2.set_ylim(-35,500)

# plt.grid(None)

plt.tight_layout()

plt.show()

irr_exchanges = [10,9,8,7,5,0] # delete those that have over 200 error days, or dominate over 10% of all time range

n -= len(irr_exchanges)

active_price.drop(active_price.columns[[irr_exchanges]], axis=1, inplace=1)

for i in irr_exchanges:

exchangelist.pop(i)

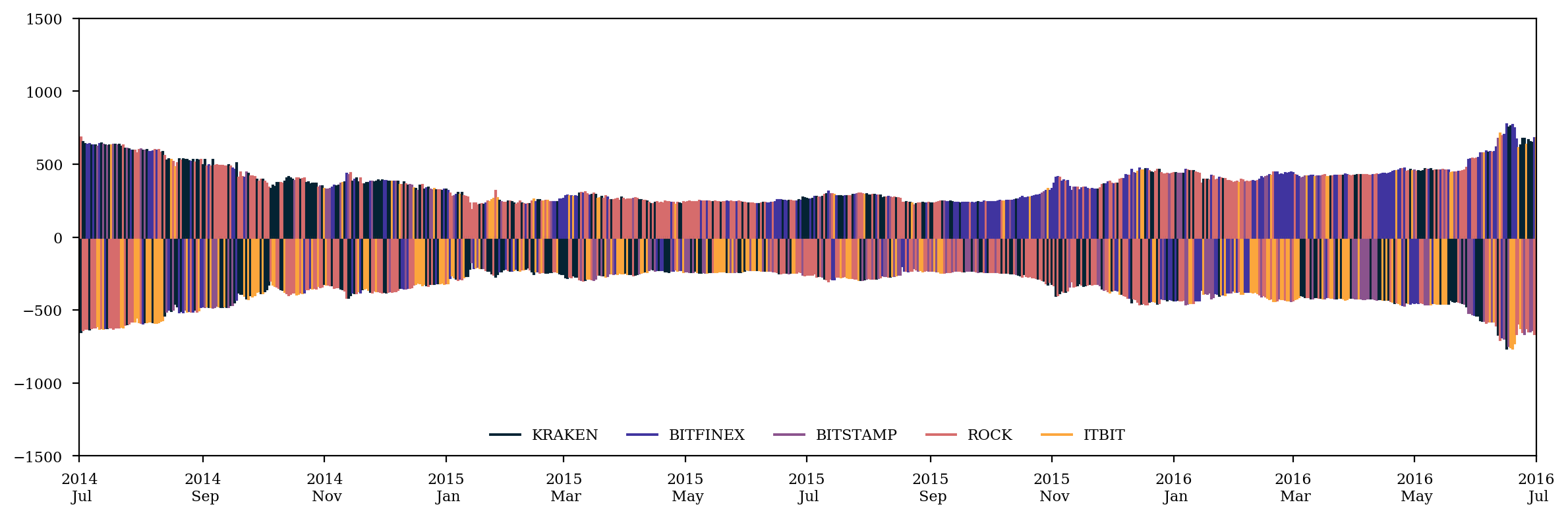

%config InlineBackend.figure_format = 'retina'

min_exchange = pd.Series([np.argmin(active_price.iloc[i], axis=0) for i in range(len(active_price))], index=active_price.index).apply(lambda fn: exchangelist.index(fn))

dmin = active_price.min(axis=1)

max_exchange = pd.Series([np.argmax(active_price.iloc[i], axis=0) for i in range(len(active_price))], index=active_price.index).apply(lambda fn: exchangelist.index(fn))

dmax = active_price.max(axis=1)

thermal = cmocean.cm.thermal

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

for i in range(n):

ax.plot((active_price.index[0], active_price.index[0]), (0, 0), c=thermal(i/n), label=exchangelist[i])

for i in range(len(active_price)):

ax.plot((active_price.index[i], active_price.index[i]), (0, -dmin[i]), lw=1.5, c=thermal(min_exchange[i]/n))

ax.plot((active_price.index[i], active_price.index[i]), (0, dmax[i]), lw=1.5, c=thermal(max_exchange[i]/n))

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(start_date, end_date)

ax.set_ylim(-1500,1500)

plt.legend(loc='lower center', frameon=0, ncol=n)

plt.tight_layout()

plt.savefig('price2.pdf')

plt.show()

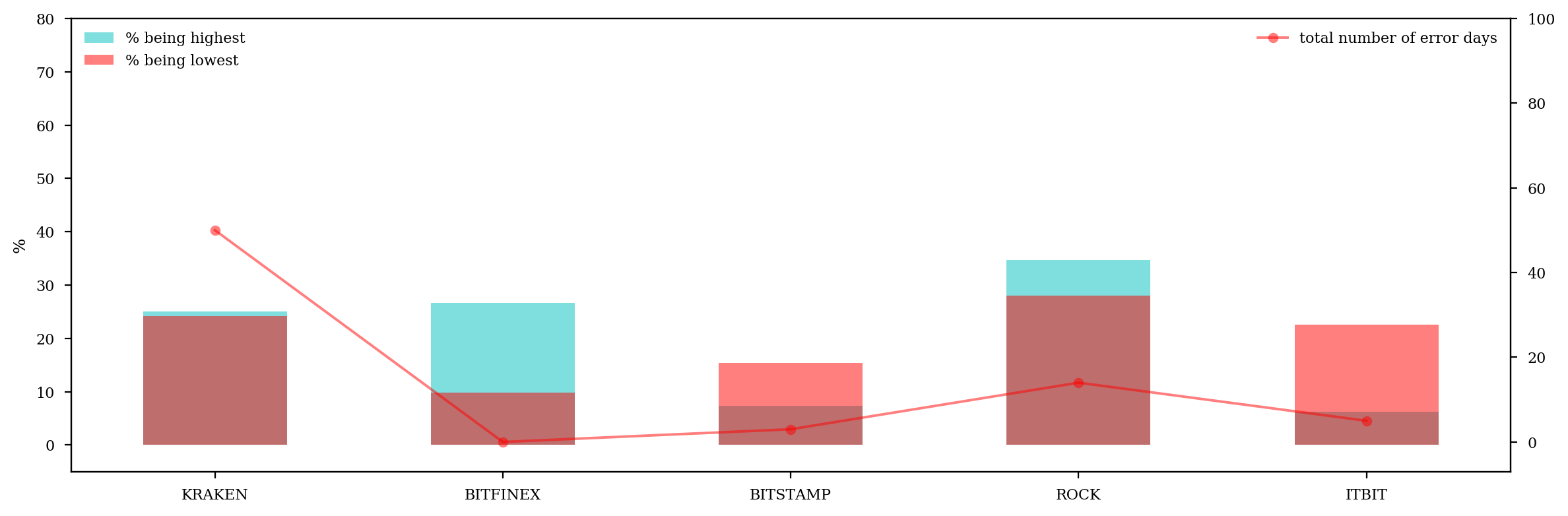

%config InlineBackend.figure_format = 'retina'

err_count = np.isnan(active_price).sum()

plt.close()

fig = plt.figure()

ax1 = fig.add_subplot(111)

(100*max_exchange.value_counts().sort_index().reindex(range(len(exchangelist))).fillna(0)/len(price)).plot.bar(ax=ax1, color='c', align='center', alpha=.5, label='% being highest')

(100*min_exchange.value_counts().sort_index().reindex(range(len(exchangelist))).fillna(0)/len(price)).plot.bar(ax=ax1, color='r', align='center', alpha=.5, label='% being lowest')

ax1.set_ylim(-5,80)

ax1.set_ylabel('%')

plt.xticks(range(len(err_count)), err_count.index.tolist(), rotation=0)

ax1.legend(loc='upper left', frameon=0)

ax2 = ax1.twinx()

err_count.plot(ax=ax2, marker='o', color='r', alpha=.5, label='total number of error days')

ax2.set_xlim(-.5,len(err_count)-.5)

ax2.set_xticks(range(len(err_count)), err_count.index.tolist())

ax2.legend(loc='upper right', frameon=0)

ax2.set_ylim(-7,100)

# plt.grid(None)

plt.tight_layout()

plt.show()

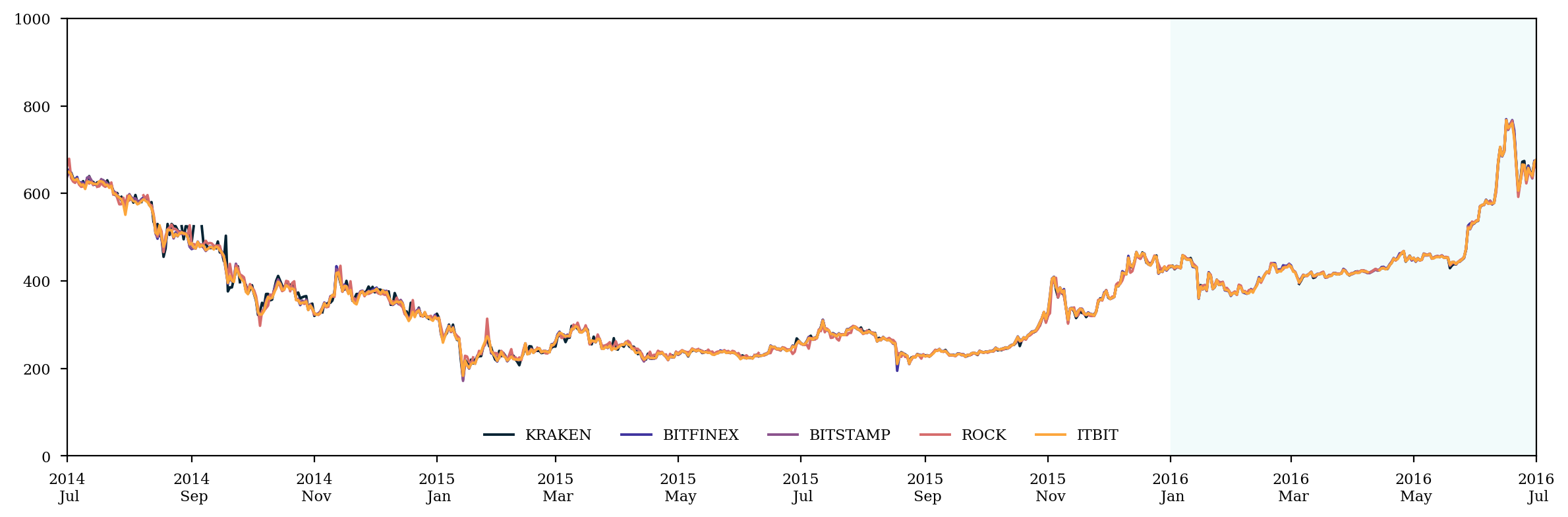

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

for i in range(n):

ax.plot(active_price.ix[:,i], c=thermal(i/n), label=exchangelist[i])

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.set_xlim(start_date, end_date)

ax.set_ylim(0,1000)

plt.legend(loc='lower center', frameon=0, ncol=n)

plt.tight_layout()

# plt.title('Historical Prices')

plt.savefig('price3.pdf')

plt.show()

price_spread = active_price.max(axis=1) - active_price.min(axis=1)

price_spread.describe()

count 732.000000

mean 7.418801

std 7.705870

min 0.150000

25% 2.430000

50% 4.914920

75% 9.461703

max 78.191470

dtype: float64

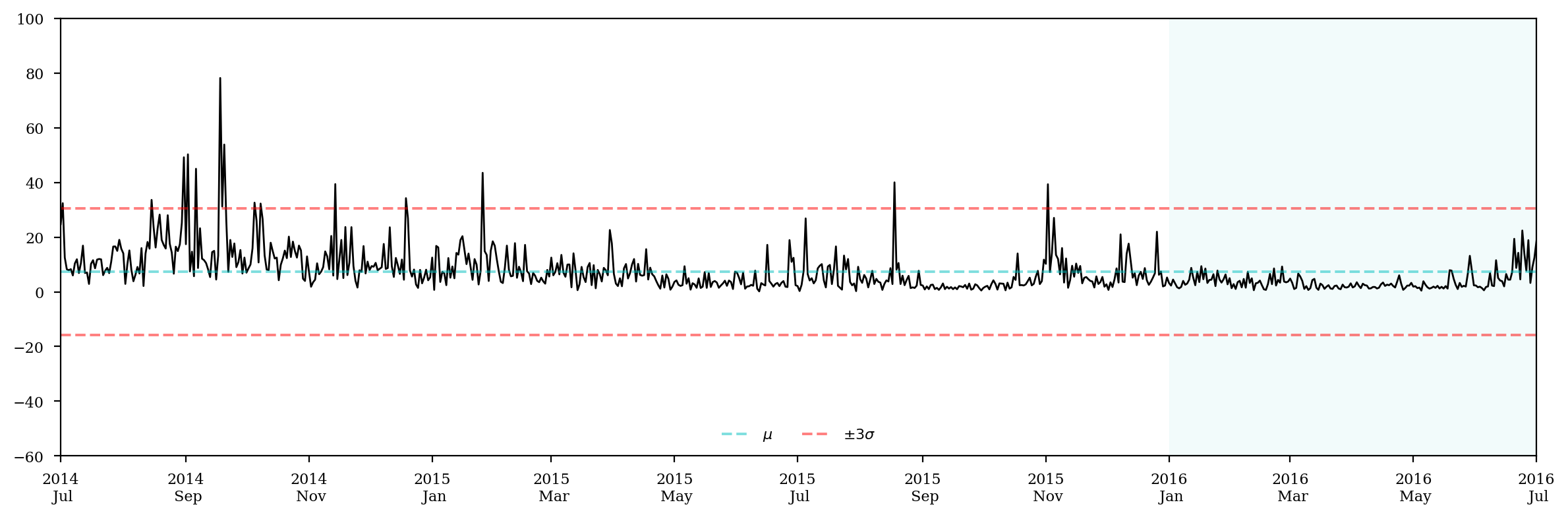

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

ax.plot(price_spread, lw=1,c='k')

ax.axhline(price_spread.mean(), alpha=0.5, ls='--', c='c', label='$\mu$')

ax.axhline(price_spread.mean()+price_spread.std()*3, alpha=0.5, ls='--', c='r', label='$\pm3\sigma$')

ax.axhline(price_spread.mean()-price_spread.std()*3, alpha=0.5, ls='--', c='r')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.set_xlim(start_date, end_date)

ax.set_ylim(-60,100)

plt.tight_layout()

plt.legend(loc='lower center', framealpha=0, ncol=2)

# plt.title('Price Spreads')

plt.savefig('spread.pdf')

plt.show()

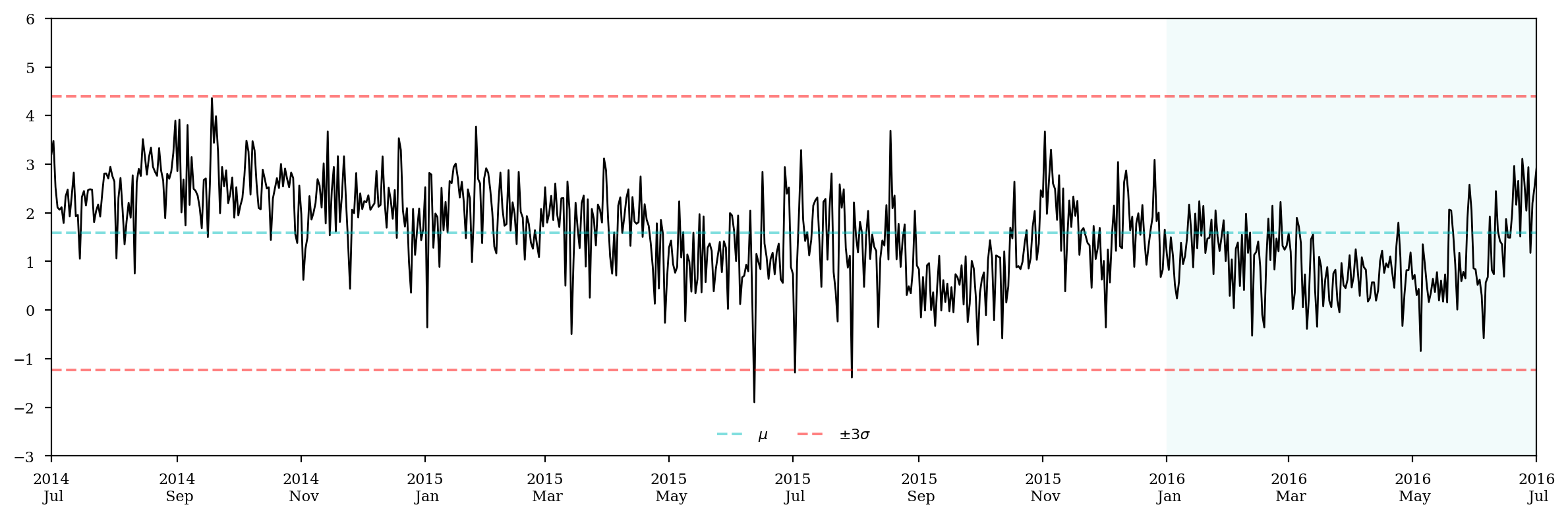

log_price_spread = np.log(price_spread)

log_price_spread.describe()

count 732.000000

mean 1.584788

std 0.939405

min -1.897120

25% 0.887891

50% 1.592275

75% 2.247244

max 4.359161

dtype: float64

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

ax.plot(log_price_spread, c='k',lw=1,label='')

ax.axhline(log_price_spread.mean(), alpha=0.5, ls='--', c='c', label='$\mu$')

ax.axhline(log_price_spread.mean()+log_price_spread.std()*3, alpha=0.5, ls='--', c='r',label='$\pm3\sigma$')

ax.axhline(log_price_spread.mean()-log_price_spread.std()*3, alpha=0.5, ls='--', c='r')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.set_ylim(-3,6)

ax.set_xlim(start_date, end_date)

plt.tight_layout()

plt.legend(loc='lower center', framealpha=0, ncol=2)

# plt.title('Log Price Spreads')

plt.savefig('logspread.pdf')

plt.show()

print(ADF(log_price_spread, trend='c'), '\n')

print(PhillipsPerron(log_price_spread, trend='c'), '\n')

Augmented Dickey-Fuller Results

=====================================

Test Statistic -2.346

P-value 0.158

Lags 17

-------------------------------------

Trend: Constant

Critical Values: -3.44 (1%), -2.87 (5%), -2.57 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

Phillips-Perron Test (Z-tau)

=====================================

Test Statistic -21.389

P-value 0.000

Lags 20

-------------------------------------

Trend: Constant Critical Values: -3.44 (1%), -2.87 (5%), -2.57 (10%) Null Hypothesis: The process contains a unit root. Alternative Hypothesis: The process is weakly stationary.

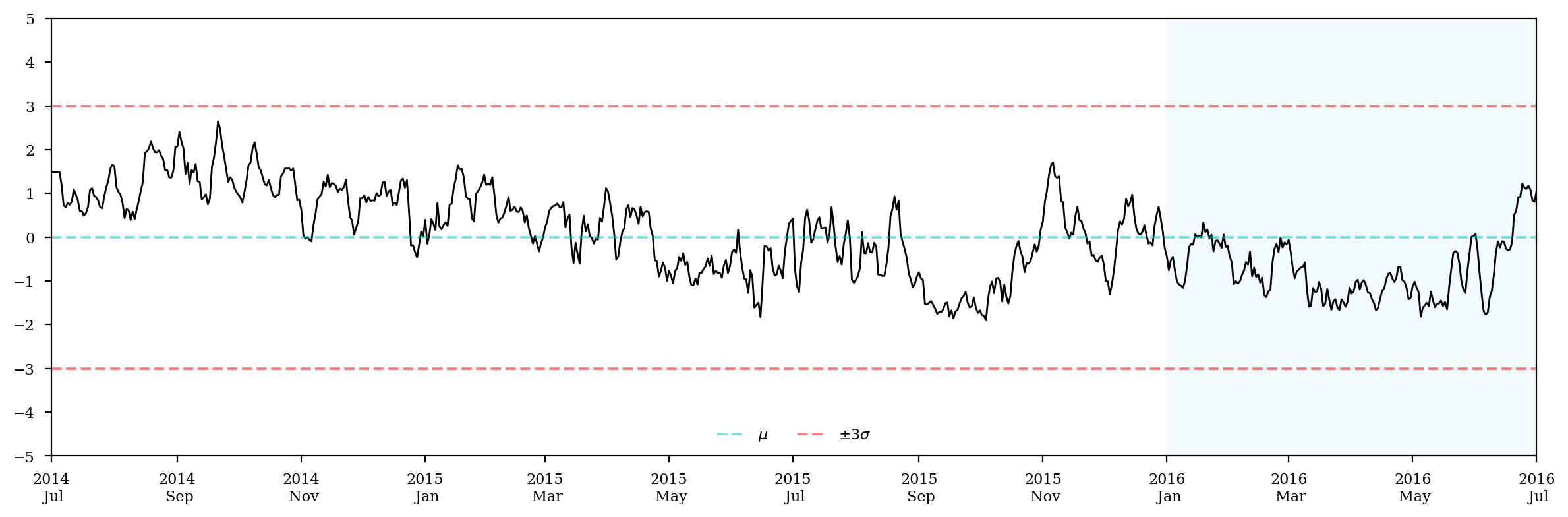

def z_norm(s):

return (s - s.mean(axis=0)) / s.std(axis=0)

log_price_spread = z_norm(log_price_spread.rolling(5).mean().fillna(method='bfill'))

log_price_spread.describe()

count 7.320000e+02

mean -4.284976e-15

std 1.000000e+00

min -1.902323e+00

25% -8.414662e-01

50% -1.734537e-02

75% 7.996859e-01

max 2.645812e+00

Name: None, dtype: float64

print(ADF(log_price_spread, trend='nc'), '\n')

print(PhillipsPerron(log_price_spread, trend='nc'), '\n')

Augmented Dickey-Fuller Results

=====================================

Test Statistic -2.229

P-value 0.025

Lags 20

-------------------------------------

Trend: No Trend

Critical Values: -2.57 (1%), -1.94 (5%), -1.62 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

Phillips-Perron Test (Z-tau)

=====================================

Test Statistic -3.321

P-value 0.001

Lags 20

-------------------------------------

Trend: No Trend

Critical Values: -2.57 (1%), -1.94 (5%), -1.62 (10%)

Null Hypothesis: The process contains a unit root.

Alternative Hypothesis: The process is weakly stationary.

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

ax.plot(log_price_spread, c='k',lw=1,label='')

ax.axhline(log_price_spread.mean(), alpha=0.5, ls='--', c='c', label='$\mu$')

ax.axhline(log_price_spread.mean()+log_price_spread.std()*3, alpha=0.5, ls='--', c='r',label='$\pm3\sigma$')

ax.axhline(log_price_spread.mean()-log_price_spread.std()*3, alpha=0.5, ls='--', c='r')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.set_ylim(-5,5)

ax.set_yticks(range(-5,6))

ax.set_xlim(start_date, end_date)

plt.tight_layout()

plt.legend(loc='lower center', framealpha=0, ncol=2)

# plt.title('Log Price Spreads')

plt.savefig('logspreadnorm.pdf')

plt.show()

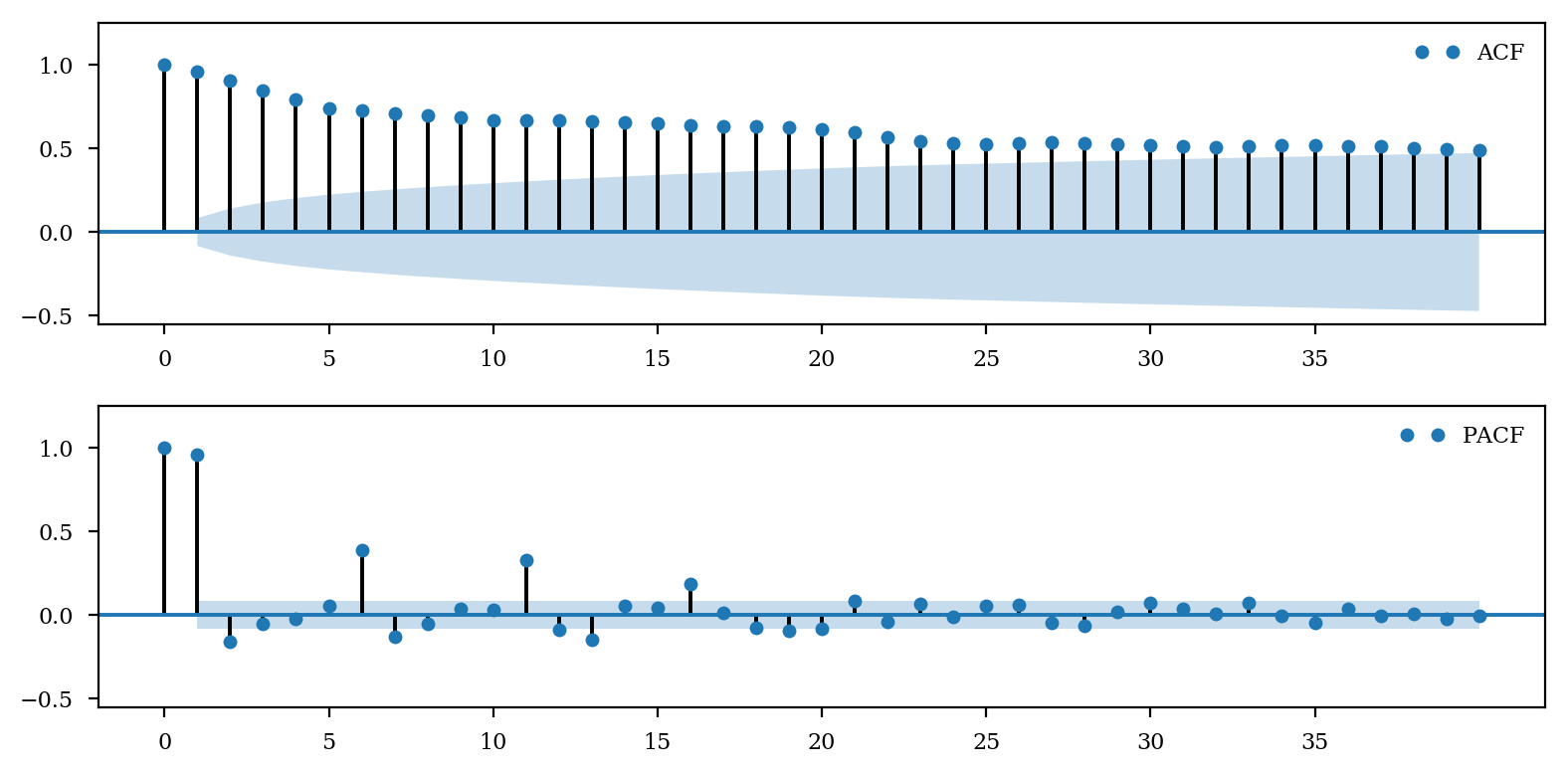

Step 4: Univariate Model - ARMA(p,q)

train = log_price_spread.loc[:mid_date]

test = log_price_spread.loc[mid_date:]

train.name = 'LogPs'

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure(figsize=(8,4))

ax1 = fig.add_subplot(211)

sm.graphics.tsa.plot_acf(train, lags=40, ax=ax1, label='ACF')

ax1.set_ylim(-.55,1.25)

ax1.set_yticks(np.arange(-.5,1.5,.5))

ax1.set_xticks(range(0,40,5))

ax1.set_title('')

handles, labels= ax1.get_legend_handles_labels()

handles = handles[:-len(handles)//3][1::2]

labels = labels[:-len(handles)//3][1::2]

ax1.legend(handles=handles, labels=labels,loc='best', frameon=0, numpoints=2)

ax2 = fig.add_subplot(212)

sm.graphics.tsa.plot_pacf(train, lags=40, ax=ax2, label='PACF')

ax2.set_ylim(-.55,1.25)

ax2.set_yticks(np.arange(-.5,1.5,.5))

ax2.set_xticks(range(0,40,5))

ax2.set_title('')

handles, labels= ax2.get_legend_handles_labels()

handles = handles[:-len(handles)//3][1::2]

labels = labels[:-len(handles)//3][1::2]

ax2.legend(handles=handles, labels=labels,loc='best', frameon=0, numpoints=2)

plt.tight_layout()

plt.savefig('uniacfpacf.pdf')

plt.show()

min_aic = min_bic = 1e5

min_aic_order = min_bic_order = (0,0)

for p in range(1,10):

for q in range(6):

model = sm.tsa.ARMA(train, (p, q))

try:

result = model.fit(trend='nc')

stat = abs(sm.stats.durbin_watson(result.resid)-2)

stat_score = (stat <= .01) * 3 + (.01 < stat <= .05) * 2 + (.05 < stat <= .10) * 1

if np.abs(np.concatenate([result.arroots, result.maroots])).min() > 1.05:

aic = result.aic

bic = result.bic

if aic < min_aic:

min_aic = aic

min_aic_order = (p,q)

if bic < min_bic:

min_bic = bic

min_bic_order = (p,q)

print('({},{}) AIC = {:>7.2f}, BIC = {:>7.2f}, |DW-2| = {:.8f} {}'.format(p,q,aic,bic,stat,stat_score*'*'))

except:

continue

print()

print('Minimum AIC = {:.2f} at {}, minimum BIC = {:.2f} at {}'.format(min_aic, min_aic_order, min_bic, min_bic_order))

(1,1) AIC = 113.26, BIC = 126.19, |DW-2| = 0.07497044 *

(1,2) AIC = 113.04, BIC = 130.28, |DW-2| = 0.06298702 *

(2,0) AIC = 111.43, BIC = 124.36, |DW-2| = 0.03723533 **

(2,1) AIC = 112.01, BIC = 129.25, |DW-2| = 0.04461551 **

(2,2) AIC = 113.29, BIC = 134.84, |DW-2| = 0.06107177 *

(3,0) AIC = 111.72, BIC = 128.96, |DW-2| = 0.05226283 *

(3,1) AIC = 113.64, BIC = 135.19, |DW-2| = 0.05401722 *

(4,0) AIC = 113.37, BIC = 134.92, |DW-2| = 0.05788130 *

(4,1) AIC = 115.31, BIC = 141.17, |DW-2| = 0.05672657 *

(5,0) AIC = 113.33, BIC = 139.19, |DW-2| = 0.00835075 ***

Minimum AIC = 111.43 at (2, 0), minimum BIC = 124.36 at (2, 0)

model = sm.tsa.ARMA(train, (2,0))

result = model.fit(trend='nc')

print(result.summary())

ARMA Model Results

==============================================================================

Dep. Variable: LogPs No. Observations: 550

Model: ARMA(2, 0) Log Likelihood -52.713

Method: css-mle S.D. of innovations 0.266

Date: Sun, 21 May 2017 AIC 111.426

Time: 01:10:53 BIC 124.355

Sample: 07-01-2014 HQIC 116.478

- 01-01-2016

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

ar.L1.LogPs 1.1236 0.042 26.763 0.000 1.041 1.206

ar.L2.LogPs -0.1672 0.042 -3.976 0.000 -0.250 -0.085

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 1.0559 +0.0000j 1.0559 0.0000

AR.2 5.6627 +0.0000j 5.6627 0.0000

-----------------------------------------------------------------------------

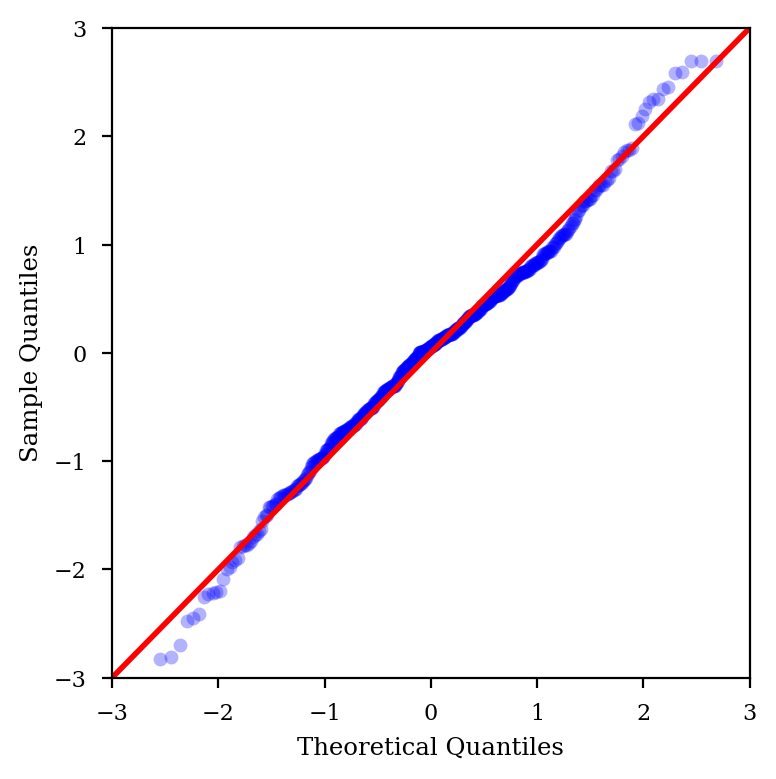

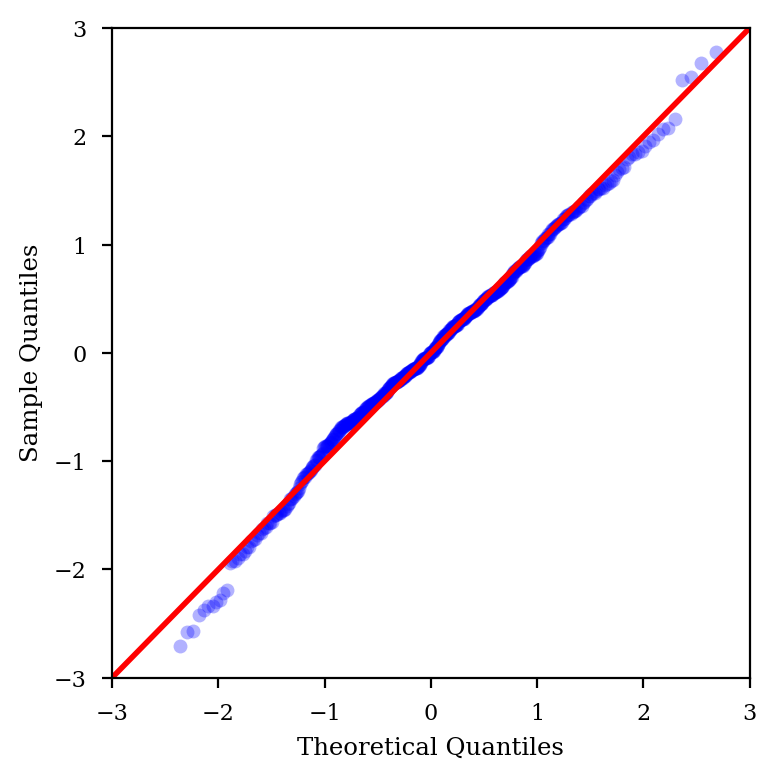

Normality test.

sm.stats.jarque_bera(result.resid)[1]

2.6180738344018359e-23

sm.stats.acorr_ljungbox(result.resid, lags=1)[1][0]

0.81633813674691746

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure(figsize=(4,4))

ax = fig.add_subplot(111)

fig = qqplot(result.resid, line='45', ax=ax, fit=True)

lines = fig.findobj(lambda x: hasattr(x, 'get_color') and x.get_color() == 'r')

dots = fig.findobj(lambda x: hasattr(x, 'get_color') and x.get_color() == 'b')

[l.set_linewidth(2) for l in lines]

[d.set_alpha(0.3) for d in dots]

# [d.set_color('c') for d in dots]

[d.set_markersize(5) for d in dots]

ax.set_ylim(-3,3)

ax.set_yticks(range(-3,4))

ax.set_xlim(-3,3)

ax.set_xticks(range(-3,4))

plt.tight_layout()

# plt.title('p-value = {}'.format(ss.normaltest(result.resid)[1]))

plt.savefig('uniqqplot.pdf')

plt.show()

phi = result.arparams * (result.pvalues[:result.k_ar]<=0.05).values

def yhat(y): # y is now nparray of shape (k_ar,2)

ylag = y[::-1]

return ylag.T @ phi

fit = result.fittedvalues

pred = test * np.nan

for i in range(len(phi)):

pred[i] = yhat(train[-1-i-len(phi):-1-i])

for i in range(len(phi), len(test)):

pred[i] = yhat(test[i-len(phi):i])

fcst = result.forecast(len(test))

forecast = pd.Series(fcst[0], index=test.index)

conf_interval = pd.DataFrame(fcst[2], index=test.index)

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

ax.plot(log_price_spread, c='k',lw=1, label='true data')

ax.plot(fit, 'ro-', markevery=10, alpha=0.5, label='insample fitted data')

# ax.plot(result.fittedvalues, 'b-')

ax.plot(pred, 'co-', markevery=10, alpha=0.5, label='outsample point forecast')

ax.plot(forecast, 'c--', label='outsample forecast')

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.fill_between(conf_interval.index, conf_interval.ix[:,0], conf_interval.ix[:,1], color='k', alpha=.1, label='95% conf. interval')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(start_date, end_date)

ax.set_ylim(-5,5)

ax.set_yticks(range(-5,6))

plt.tight_layout()

plt.legend(loc='lower center', framealpha=0, ncol=5)

# plt.title('First Difference Log Price Spreads')

plt.savefig('unifit1.pdf')

plt.show()

temp_date = pd.to_datetime('2015-12-01')

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

ax.plot(log_price_spread, c='k',lw=1, label='true data')

ax.plot(fit, 'ro-', markevery=5, alpha=0.5, label='insample fitted data')

ax.plot(pred, 'co-', markevery=5, alpha=0.5, label='outsample point forecast')

ax.plot(forecast, 'c--', alpha=0.5, label='outsample forecast')

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.fill_between(conf_interval.index, conf_interval.ix[:,0], conf_interval.ix[:,1], color='k', alpha=.1, label='95% conf. interval')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=1))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(temp_date, end_date)

ax.set_ylim(-5,5)

ax.set_yticks(range(-5,6))

plt.tight_layout()

plt.legend(loc='lower center', framealpha=0, ncol=5)

# plt.title('First Difference Log Price Spreads')

plt.savefig('unifit2.pdf')

plt.show()

MASE (Mean Absolute Scaled Error): https://en.wikipedia.org/wiki/Mean_absolute_scaled_error

- Better than MAPE: MASE is symmetric while MAPE punishes on negative errors

- Better than RMSE: scaled to the data

- Better than R-squares: parameter number irrelavant

- Better than AUC and Predictive Likelihood: easier to compute

def mase(data, pred):

error = data - pred

ydiff = data.diff().dropna()

return error.abs().mean() / ydiff.abs().mean()

mase_uni_is = mase(train, fit)

mase_uni_osp = mase(test, pred)

mase_uni_os = mase(test, forecast)

print('MASE insample is {:.3f}'.format(mase_uni_is))

print('MASE outsample point is {:.3f}'.format(mase_uni_osp))

print('MASE outsample is {:.3f}'.format(mase_uni_os))

MASE insample is 0.996

MASE outsample point is 0.991

MASE outsample is 4.704

Step 5: Multivariate Model - ARIMAX(p,d,q)

data = [

'BCHAIN/ATRCT', # Bitcoin Median Transaction Confirmation Time

'BCHAIN/CPTRA', # Bitcoin Cost Per Transaction

'BCHAIN/DIFF', # Bitcoin Mining Difficulty

'BCHAIN/TVTVR', # Bitcoin Trade Volume vs Transaction Volume Ratio

]

ind = [quandl.get(d)[start_date:end_date] for d in data]

max_volume = ((volume.apply(lambda v:v.index, axis=1).T == max_exchange.apply(lambda i:exchangelist[i])).T * volume).sum(axis=1)

min_volume = ((volume.apply(lambda v:v.index, axis=1).T == min_exchange.apply(lambda i:exchangelist[i])).T * volume).sum(axis=1)

trade_volume = max_volume + min_volume

transaction_volume = (trade_volume * ind[-1].T).T

ind[-1] = transfer_volume = transaction_volume.Value - trade_volume

dataset = pd.concat([price_spread, trade_volume] + ind, axis=1, join='outer')

dataset.columns = ['Ps', 'Tr', 'Ct', 'Co', 'Di', 'Tf']

print(dataset.describe())

Ps Tr Ct Co Di Tf

count 732.000000 732.000000 732.000000 732.000000 7.320000e+02 732.000000

mean 7.418801 727.610416 8.056266 12.379825 7.563867e+10 22286.774041

std 7.705870 243.943093 1.111682 8.532508 5.491585e+10 23071.094095

min 0.150000 356.410000 5.883333 3.442916 1.681846e+10 1057.026608

25% 2.430000 499.281875 7.333333 7.574733 4.055572e+10 7382.009772

50% 4.914920 713.810010 7.875000 8.890402 4.969239e+10 12993.766448

75% 9.461703 864.820000 8.600000 13.035012 9.605659e+10 29144.912952

max 78.191470 1532.508000 14.130000 49.667654 2.094532e+11 136972.126998

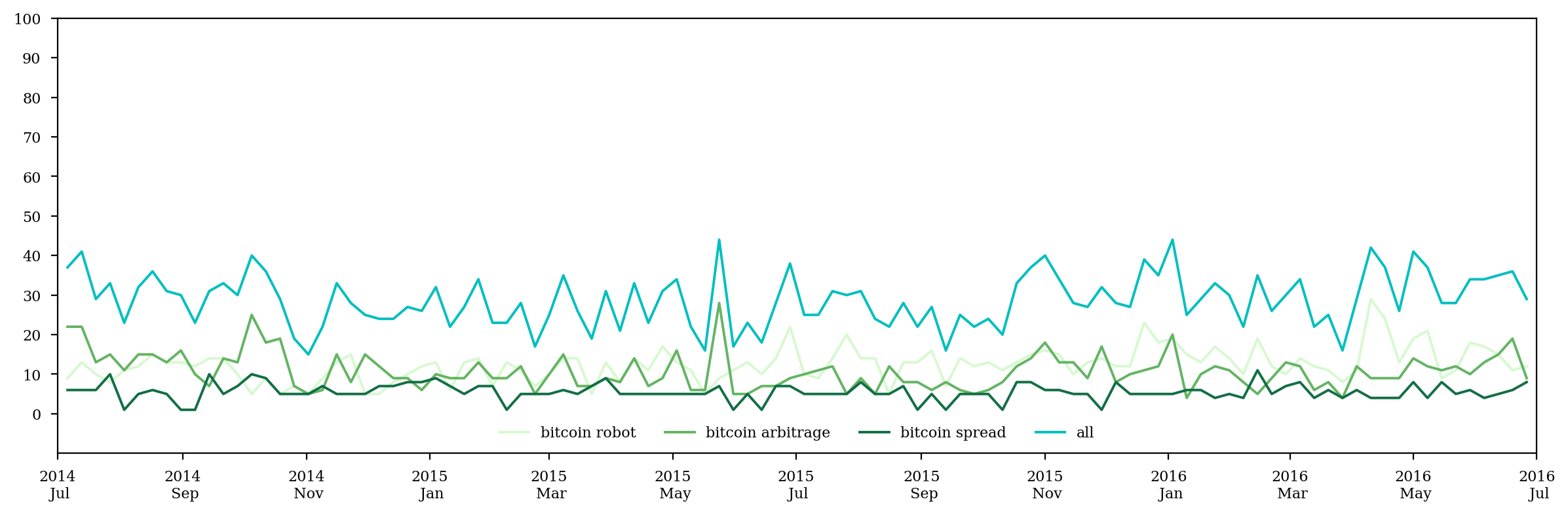

googletrends = []

kw_list = ['bitcoin robot', 'bitcoin arbitrage', 'bitcoin spread']

pytrend.build_payload(kw_list=kw_list)

googletrends = pytrend.interest_over_time().ix[start_date:end_date, :] + 1 # as googletrends can be 0 from time to time, which is troublesome for taking log

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

for i in range(len(kw_list)):

ax.plot(googletrends.ix[:,i], c=cmocean.cm.algae(i/len(kw_list)), label=kw_list[i])

ax.plot(googletrends.sum(axis=1), c='c', label='all')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(start_date, end_date)

plt.tight_layout()

plt.legend(loc='lower center', frameon=0, ncol=len(kw_list)+1)

plt.ylim(-10,100)

plt.yticks(range(0,101,10))

plt.savefig('multrend.pdf')

plt.show()

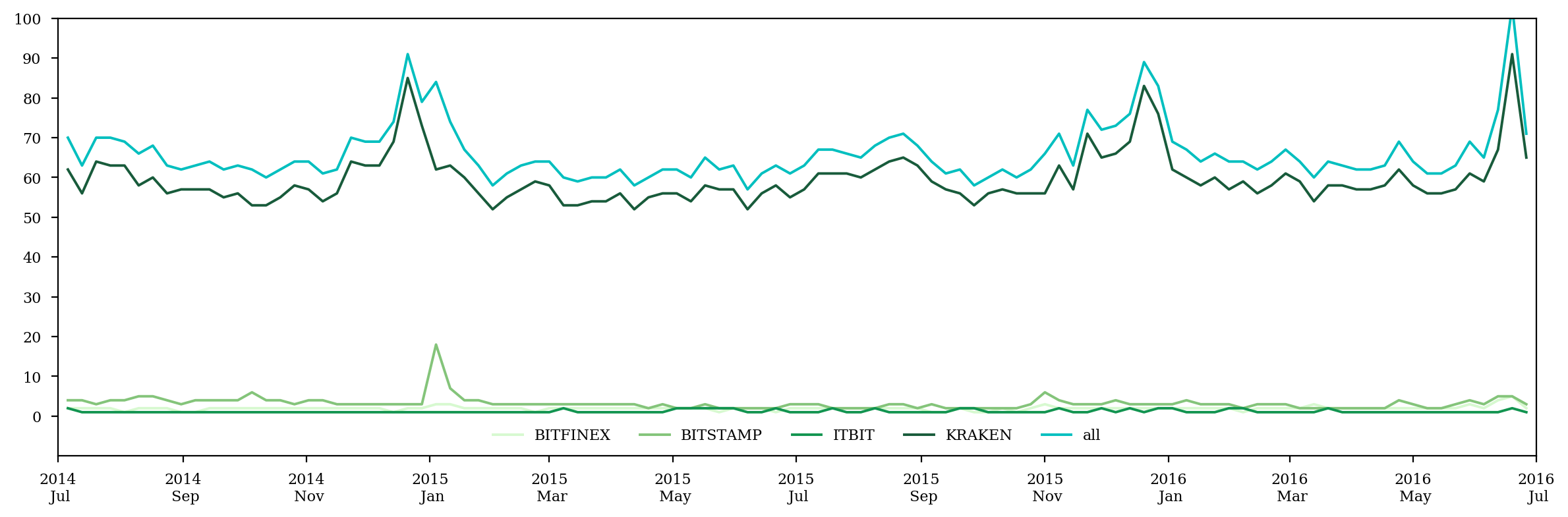

exchangetrends = []

kw_list = np.setdiff1d(exchangelist, ['ROCK'])

pytrend.build_payload(kw_list=kw_list)

exchangetrends = pytrend.interest_over_time().ix[start_date:end_date, :] + 1

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

for i in range(len(kw_list)):

ax.plot(exchangetrends.ix[:,i], color=cmocean.cm.algae(i/len(kw_list)), label=kw_list[i])

ax.plot(exchangetrends.sum(axis=1), c='c', label='all')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(start_date, end_date)

plt.tight_layout()

plt.legend(loc='lower center', frameon=0, ncol=len(kw_list)+1)

plt.ylim(-10,100)

plt.yticks(range(0,101,10))

plt.savefig('multrend.pdf')

plt.show()

dataset = pd.concat([dataset, googletrends.sum(axis=1), exchangetrends.sum(axis=1)], axis=1, join='outer').fillna(method='ffill').fillna(method='bfill')

dataset.columns = list(dataset.columns[:-2]) + ['Gt1', 'Gt2']

dataset.Gt1.interpolate(inplace=1)

dataset.Gt2.interpolate(inplace=1)

log_dataset = z_norm(np.log(dataset).rolling(5).mean().fillna(method='bfill'))

log_dataset.columns = ['Log'+c for c in log_dataset.columns]

print(log_dataset.describe())

LogPs LogTr LogCt LogCo LogDi LogTf LogGt1 LogGt2

count 7.320000e+02 7.320000e+02 7.320000e+02 7.320000e+02 7.320000e+02 7.320000e+02 7.320000e+02 7.320000e+02

mean -4.284976e-15 1.526951e-14 2.660744e-14 -2.311827e-16 5.078330e-14 -1.000566e-14 4.753939e-15 9.735989e-15

std 1.000000e+00 1.000000e+00 1.000000e+00 1.000000e+00 1.000000e+00 1.000000e+00 1.000000e+00 1.000000e+00

min -1.902323e+00 -1.600349e+00 -2.681378e+00 -1.602305e+00 -1.918163e+00 -2.449733e+00 -2.868102e+00 -1.541291e+00

25% -8.414662e-01 -1.003732e+00 -6.189083e-01 -6.491453e-01 -5.965383e-01 -7.432149e-01 -6.731405e-01 -6.369187e-01

50% -1.734537e-02 8.771289e-02 -2.819185e-02 -4.128926e-01 -2.796970e-01 -1.754303e-01 4.339693e-02 -2.954394e-01

75% 7.996859e-01 6.973955e-01 5.295034e-01 4.580167e-01 6.834602e-01 6.506610e-01 7.555832e-01 4.566839e-01

max 2.645812e+00 2.439251e+00 3.834172e+00 2.765270e+00 1.896075e+00 2.321454e+00 2.077746e+00 4.822614e+00

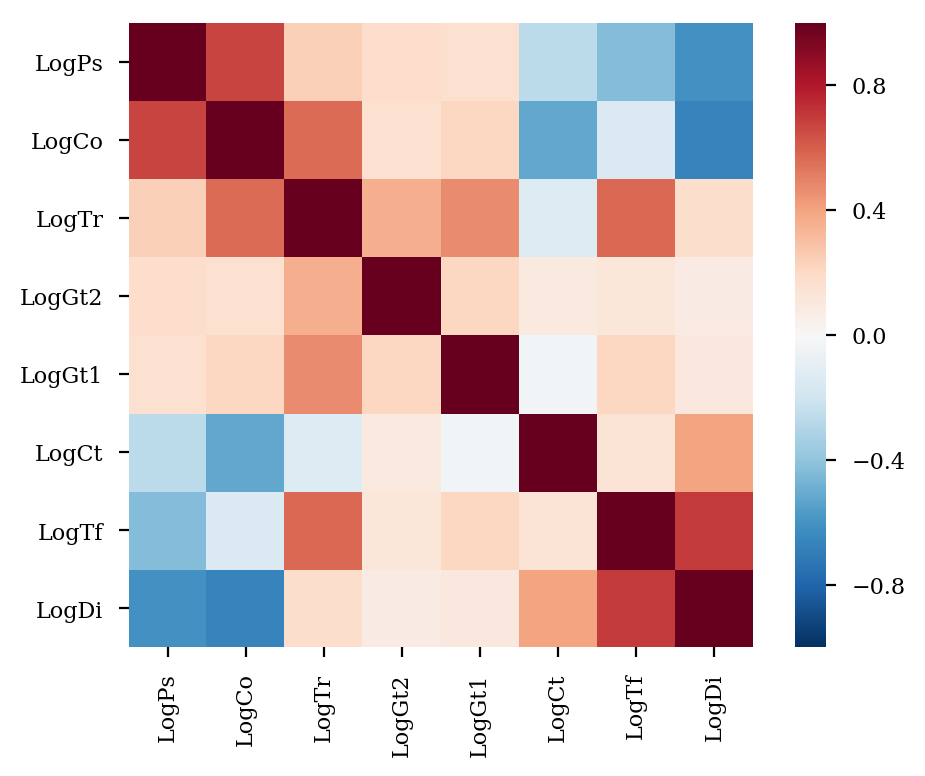

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure(figsize=(5,4))

ax = fig.add_subplot(111)

idx = log_dataset.corr().sort_values(by='LogPs', ascending=0).index

log_dataset = log_dataset.ix[:,idx]

corr = log_dataset.corr()

sns.heatmap(corr, square=1, ax=ax)

plt.yticks(rotation=0)

plt.xticks(rotation=90)

plt.tight_layout()

plt.savefig('mulcorr.pdf')

plt.show()

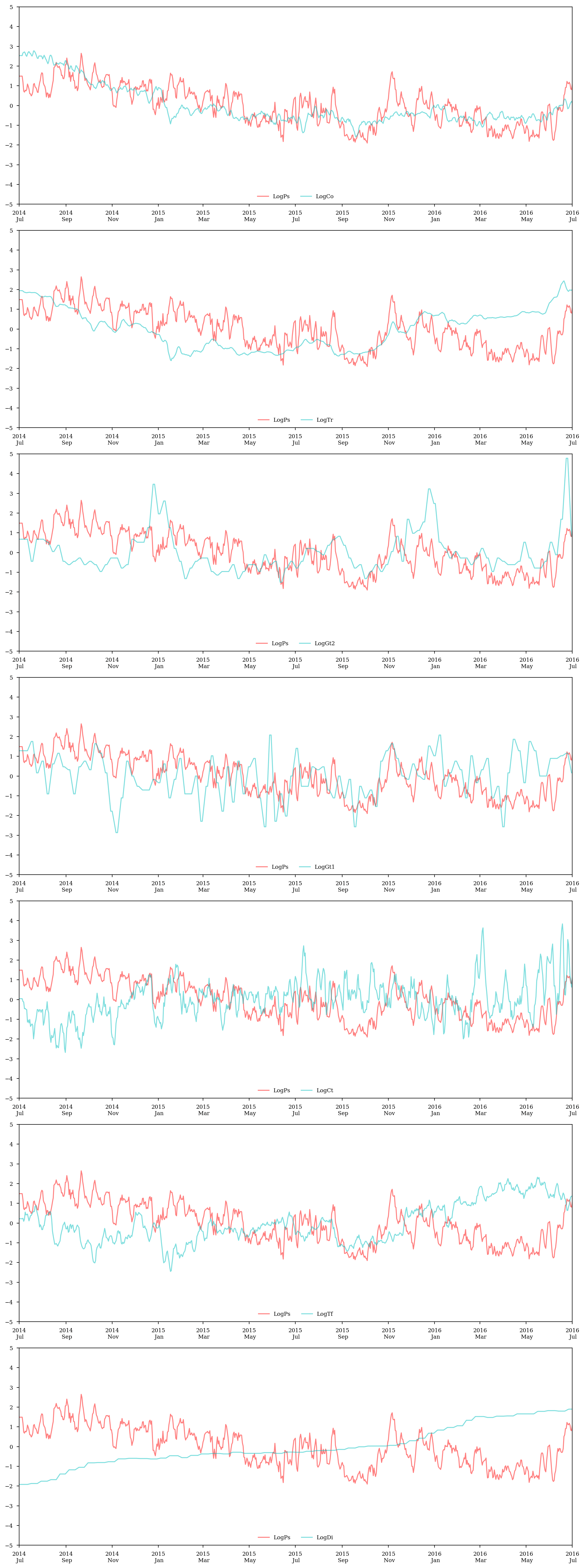

fig = plt.figure(figsize=(12,4*len(corr)))

for i in range(len(corr)-1):

ax = fig.add_subplot(len(corr)-1,1,i+1)

ax.plot(log_price_spread, c='r', label='LogPs', alpha=.5)

ax.plot(log_dataset.ix[:,i+1], c='c', alpha=.5, label=log_dataset.columns[i+1])

ax.legend(frameon=0,loc='lower center', ncol=2)

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(start_date, end_date)

ax.set_ylim(-5,5)

ax.set_yticks(range(-5,6))

plt.tight_layout()

plt.show()

endog = log_dataset.LogPs

exog = log_dataset.ix[:,np.setdiff1d(log_dataset.columns,['LogPs'])]

train_endog = endog.ix[start_date:mid_date]

train_exog = exog.ix[start_date:mid_date]

test_endog = endog.ix[mid_date:end_date]

test_exog = exog.ix[mid_date:end_date]

min_aic = min_bic = 1e5

min_aic_order = min_bic_order = (0,0,0)

for p in range(1,10):

for q in range(3):

for d in range(1):

model = sm.tsa.SARIMAX(train_endog, train_exog, (p, d, q))

try:

result = model.fit(trend='nc')

result.summary()

except:

continue

stat = abs(sm.stats.durbin_watson(result.resid)-2)

stat_score = (stat <= 0.01) * 3 + (0.01 < stat <= 0.05) * 2 + (0.05 < stat <= 0.10) * 1

if np.abs(np.concatenate([result.arroots, result.maroots])).min() > 1.05:

aic = result.aic

bic = result.bic

if aic < min_aic:

min_aic = aic

min_aic_order = (p,d,q)

if bic < min_bic:

min_bic = bic

min_bic_order = (p,d,q)

print('({},{},{}) AIC = {:>7.2f}, BIC = {:>7.2f}, |DW-2| = {:.8f} {}'.format(p,d,q,aic,bic,stat,stat_score*'*'))

print()

print('Minimum AIC = {:.2f} at {}, minimum BIC = {:.2f} at {}'.format(min_aic, min_aic_order, min_bic, min_bic_order))

(1,0,0) AIC = 95.23, BIC = 134.02, |DW-2| = 0.32750528

(1,0,1) AIC = 82.47, BIC = 125.56, |DW-2| = 0.03040248 **

(1,0,2) AIC = 81.51, BIC = 128.92, |DW-2| = 0.01859667 **

(2,0,0) AIC = 79.67, BIC = 122.77, |DW-2| = 0.02601878 **

(2,0,1) AIC = 77.37, BIC = 124.78, |DW-2| = 0.02101876 **

(2,0,2) AIC = 77.46, BIC = 129.18, |DW-2| = 0.02477762 **

(3,0,0) AIC = 77.69, BIC = 125.10, |DW-2| = 0.00997169 ***

(3,0,1) AIC = 75.14, BIC = 126.85, |DW-2| = 0.00109986 ***

(4,0,0) AIC = 75.70, BIC = 127.42, |DW-2| = 0.00565012 ***

(4,0,1) AIC = 77.69, BIC = 133.72, |DW-2| = 0.00489150 ***

(5,0,0) AIC = 77.64, BIC = 133.67, |DW-2| = 0.00382267 ***

(5,0,1) AIC = 56.67, BIC = 117.01, |DW-2| = 0.11066651

(6,0,0) AIC = -11.64, BIC = 48.69, |DW-2| = 0.10243475

(6,0,1) AIC = -16.11, BIC = 48.54, |DW-2| = 0.02155382 **

(6,0,2) AIC = -16.40, BIC = 52.56, |DW-2| = 0.00558554 ***

(7,0,0) AIC = -18.40, BIC = 46.25, |DW-2| = 0.00766101 ***

(7,0,1) AIC = -16.75, BIC = 52.20, |DW-2| = 0.00203650 ***

(7,0,2) AIC = -15.06, BIC = 58.20, |DW-2| = 0.00505927 ***

(8,0,0) AIC = -17.85, BIC = 51.11, |DW-2| = 0.00599037 ***

(8,0,1) AIC = -21.57, BIC = 51.70, |DW-2| = 0.01490724 **

(8,0,2) AIC = -18.89, BIC = 58.69, |DW-2| = 0.02765866 **

(9,0,0) AIC = -15.87, BIC = 57.40, |DW-2| = 0.00530673 ***

(9,0,1) AIC = -20.02, BIC = 57.56, |DW-2| = 0.00183866 ***

(9,0,2) AIC = -17.87, BIC = 64.01, |DW-2| = 0.01105891 **

Minimum AIC = -21.57 at (8, 0, 1), minimum BIC = 46.25 at (7, 0, 0)

model = sm.tsa.SARIMAX(train_endog, train_exog, (8,0,1), freq='D')

result = model.fit(trend='nc')

print(result.summary())

Statespace Model Results

==============================================================================

Dep. Variable: LogPs No. Observations: 550

Model: SARIMAX(8, 0, 1) Log Likelihood 27.783

Date: Sun, 21 May 2017 AIC -21.566

Time: 01:13:14 BIC 51.703

Sample: 07-01-2014 HQIC 7.066

- 01-01-2016

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

LogCo 0.3659 0.181 2.024 0.043 0.012 0.720

LogCt 0.0089 0.039 0.224 0.823 -0.069 0.086

LogDi -0.0414 0.266 -0.156 0.876 -0.563 0.480

LogGt1 0.0069 0.061 0.113 0.910 -0.113 0.127

LogGt2 -0.0132 0.084 -0.157 0.875 -0.178 0.152

LogTf -0.3987 0.087 -4.557 0.000 -0.570 -0.227

LogTr 0.3262 0.180 1.815 0.069 -0.026 0.678

ar.L1 0.3475 0.168 2.063 0.039 0.017 0.678

ar.L2 0.7677 0.183 4.200 0.000 0.409 1.126

ar.L3 -0.1169 0.054 -2.171 0.030 -0.222 -0.011

ar.L4 -0.0721 0.051 -1.402 0.161 -0.173 0.029

ar.L5 -0.4598 0.047 -9.752 0.000 -0.552 -0.367

ar.L6 0.2162 0.088 2.468 0.014 0.045 0.388

ar.L7 0.3528 0.077 4.600 0.000 0.202 0.503

ar.L8 -0.1733 0.044 -3.953 0.000 -0.259 -0.087

ma.L1 0.7612 0.174 4.369 0.000 0.420 1.103

sigma2 0.0526 0.003 18.715 0.000 0.047 0.058

===================================================================================

Ljung-Box (Q): 138.21 Jarque-Bera (JB): 28.29

Prob(Q): 0.00 Prob(JB): 0.00

Heteroskedasticity (H): 1.54 Skew: -0.30

Prob(H) (two-sided): 0.00 Kurtosis: 3.93

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

sm.stats.durbin_watson(result.resid)

1.9750927630586519

sm.stats.jarque_bera(result.resid)[1]

7.8859408081166919e-07

sm.stats.acorr_ljungbox(result.resid, lags=1)[1][0]

0.87455062641970893

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure(figsize=(4,4))

ax = fig.add_subplot(111)

fig = qqplot(result.resid, line='45', ax=ax, fit=True)

lines = fig.findobj(lambda x: hasattr(x, 'get_color') and x.get_color() == 'r')

dots = fig.findobj(lambda x: hasattr(x, 'get_color') and x.get_color() == 'b')

[l.set_linewidth(2) for l in lines]

[d.set_alpha(0.3) for d in dots]

[d.set_markersize(5) for d in dots]

ax.set_ylim(-3,3)

ax.set_yticks(range(-3,4))

ax.set_xlim(-3,3)

ax.set_xticks(range(-3,4))

plt.tight_layout()

# plt.title('p-value = {}'.format(ss.normaltest(result.resid)[1]))

plt.savefig('mulqqplot.pdf')

plt.show()

forecast = result.forecast(steps=len(test_endog), exog=test_exog)

fit = result.fittedvalues

model = sm.tsa.statespace.SARIMAX(endog, exog, model.order)

result = model.filter(result.params)

predict = result.get_prediction()

pred = predict.predicted_mean[mid_date:]

conf_interval = [forecast+predict.se_mean[len(train_endog):]*1.96,forecast-predict.se_mean[len(train_endog):]*1.96]

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

ax.plot(log_price_spread, c='k',lw=1, label='true data')

ax.plot(fit, 'ro-', markevery=10, alpha=0.5, label='insample fitted data')

ax.plot(pred, 'co-', markevery=10, alpha=0.5, label='outsample point forecast')

ax.plot(forecast, 'c--', label='outsample forecast')

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.fill_between(test_endog.index, conf_interval[0], conf_interval[1], color='k', alpha=.1, label='95% conf. interval')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=2))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(start_date, end_date)

ax.set_ylim(-5,5)

ax.set_yticks(range(-5,6))

plt.tight_layout()

plt.legend(loc='lower center', framealpha=0, ncol=5)

# plt.title('First Difference Log Price Spreads')

plt.savefig('mulfit1.pdf')

plt.show()

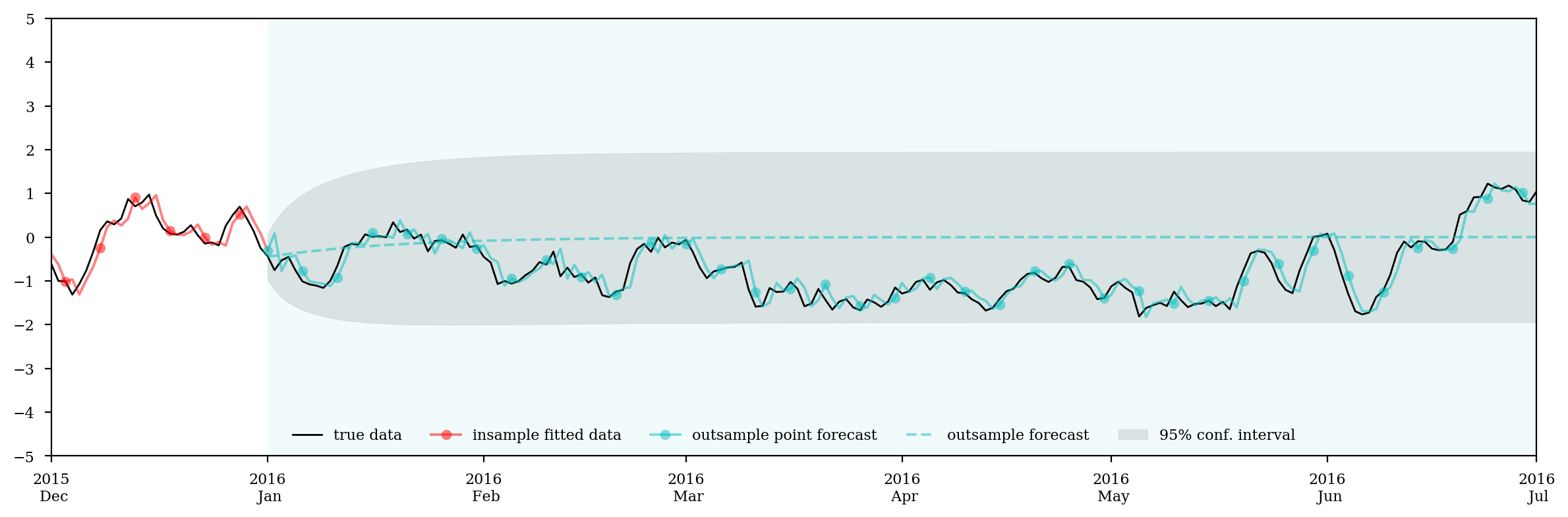

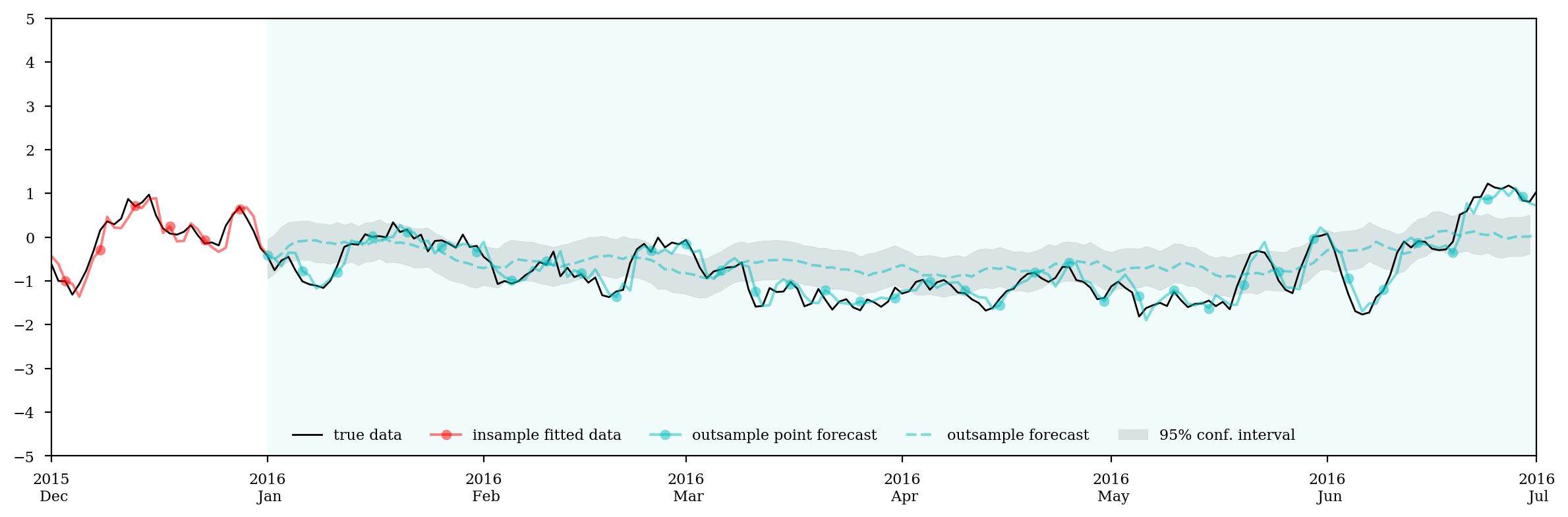

%config InlineBackend.figure_format = 'retina'

plt.close()

fig = plt.figure()

ax = fig.add_subplot(111)

ax.plot(log_price_spread, c='k',lw=1, label='true data')

ax.plot(fit, 'ro-', markevery=5, alpha=0.5, label='insample fitted data')

ax.plot(pred, 'co-', markevery=5, alpha=0.5, label='outsample point forecast')

ax.plot(forecast, 'c--', alpha=0.5, label='outsample forecast')

ax.axvspan(mid_date, end_date, color='c', alpha=0.05)

ax.fill_between(test_endog.index, conf_interval[0], conf_interval[1], color='k', alpha=.1, label='95% conf. interval')

ax.xaxis.set_major_locator(mdates.MonthLocator(interval=1))

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y\n %b'))

ax.set_xlim(temp_date, end_date)

ax.set_ylim(-5,5)

ax.set_yticks(range(-5,6))

plt.tight_layout()

plt.legend(loc='lower center', framealpha=0, ncol=5)

# plt.title('First Difference Log Price Spreads')

plt.savefig('mulfit2.pdf')

plt.show()

mase_mul_is = mase(train_endog, fit)

mase_mul_osp = mase(test_endog, pred)

mase_mul_os = mase(test_endog, forecast)

print('MASE insample is {:.3f}'.format(mase_mul_is))

print('MASE outsample is {:.3f}'.format(mase_mul_osp))

print('MASE outsample is {:.3f}'.format(mase_mul_os))

MASE insample is 0.858

MASE outsample is 0.857

MASE outsample is 2.688

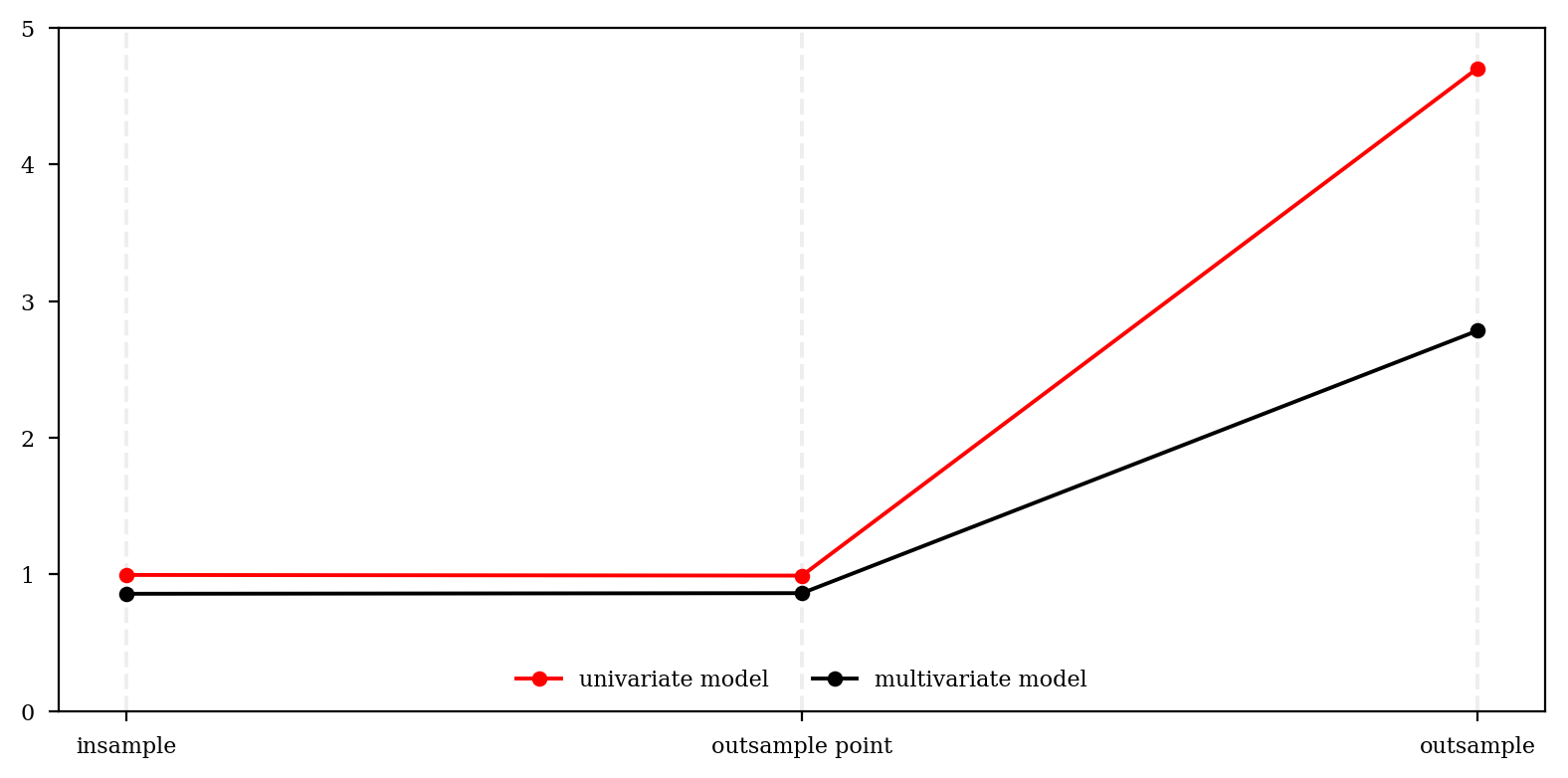

uni = np.array([mase_uni_is, mase_uni_osp, mase_uni_os])

mul = np.array([mase_mul_is, mase_mul_osp, mase_mul_os])

print(uni)

print(mul)

[ 0.99605648 0.99134227 4.70378576]

[ 0.8576784 0.85705027 2.68798458]

plt.figure(figsize=(8,4))

plt.plot((0,0),(0,5),'#eeeeee',ls='--')

plt.plot((1,1),(0,5),'#eeeeee',ls='--')

plt.plot((2,2),(0,5),'#eeeeee',ls='--')

plt.plot(uni, 'ro-', label='univariate model')

plt.plot(mul, 'ko-', label='multivariate model')

plt.legend(loc='lower center', frameon=0, ncol=2)

plt.xticks(range(3),['insample', 'outsample point', 'outsample'])

# plt.title('MASE Scores')

plt.yticks(np.arange(0,6))

plt.ylim(0,5)

plt.tight_layout()

plt.savefig('mase.pdf')

plt.show()

Step 6: Conclusion

So our exogenous indicators do work. We’ll see what else we can do with the multivariate model next time.