Strategy: LSTM Neural Network + Small Cap

2017-01-17

This post covers the introduction to a simple LSTM neural network strategy in China A-share market, as well as its programming realization. Here we use RqAlpha’s trading API.

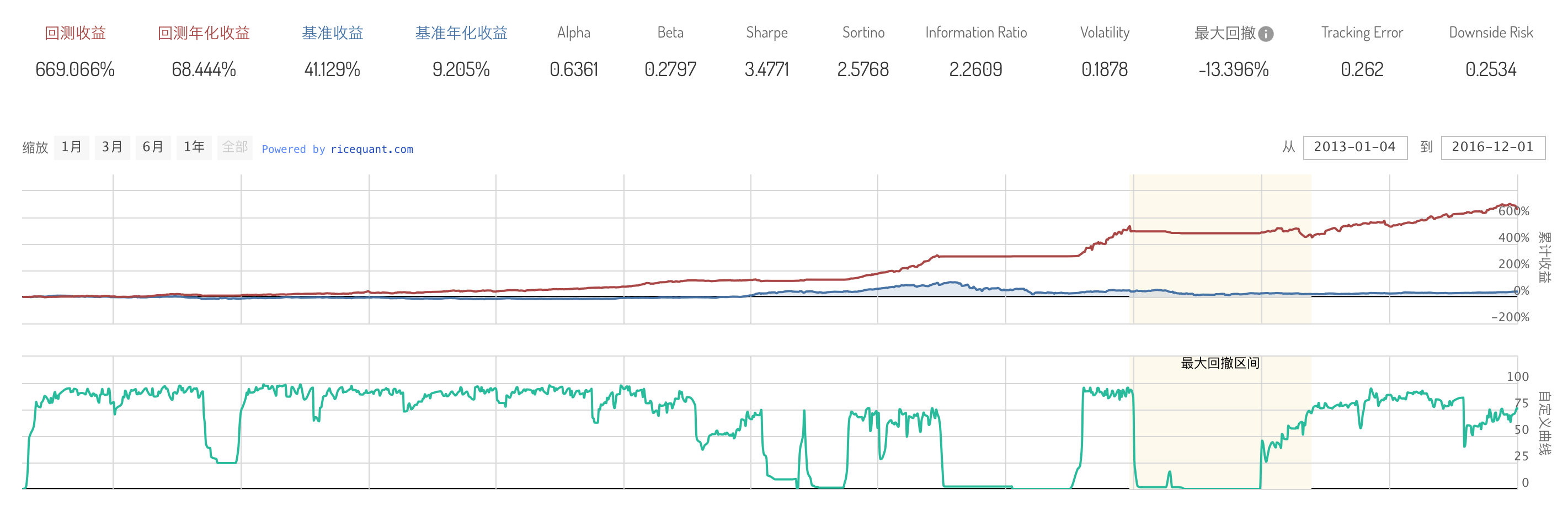

Performance

| Info | Result |

|---|---|

| Backtest Interval | 20130101 - 20170101 |

| Initial Capital | 1,000,000 |

| Annualized Return (Strategy) | 68.444% |

| Annualized Return (Benchmark) | 9.205% |

| Sharpe Ratio | 3.4771 |

| Maximum Drawdown | -13.396% |

Intuition: Small Cap

It is quite intuitive that small cap companies generally embrace larger probability to go up. Also, due to market making in A-share market, small caps usually have more stable paterns. These two facts hold from bear to bull and are rarely violated.

Tool: LSTM Neural Network

LSTM is an RNN network model. It’s strength is in efficiently processing text and time series of various length. For more detailed information, check this out.

Codes

'''

author: Allen Frostline

update: 2017-01-16

'''

# some importance libraries

import pandas as pd

import numpy as np

from datetime import timedelta

from pybrain.datasets import SequentialDataSet

from pybrain.tools.shortcuts import buildNetwork

from pybrain.structure.networks import Network

from pybrain.structure.modules import ReluLayer, LSTMLayer

from pybrain.supervised import RPropMinusTrainer

# train on trainX and trainY, return a net and its score

def train(context, trainX, trainY):

ds = SequentialDataSet(4, 1)

for dataX, dataY in zip(trainX, trainY):

ds.addSample(dataX, dataY)

net = buildNetwork(4, 1, 1, hiddenclass=LSTMLayer, outputbias=False, recurrent=True)

trainer = RPropMinusTrainer(net, dataset=ds)

EPOCHS_PER_CYCLE = 5

CYCLES = 5

for i in range(CYCLES):

trainer.trainEpochs(EPOCHS_PER_CYCLE)

return net, trainer.testOnData()

# update data

def load(context, ticker):

close = history_bars(ticker, 180, '1d', 'close')

high = history_bars(ticker, 180, '1d', 'high')

low = history_bars(ticker, 180, '1d', 'low')

volume= history_bars(ticker, 180, '1d', 'volume')

data = np.matrix([close, high, low, volume])

context.position_ratio.append(np.array([close.mean(), high.mean(), low.mean(), volume.mean()]))

context.shape_ratio.append(np.array([close.std(), high.std(), low.std(), volume.std()]))

data[0,:] = (data[0,:] - context.position_ratio[-1][0]) / context.shape_ratio[-1][0]

data[1,:] = (data[1,:] - context.position_ratio[-1][1]) / context.shape_ratio[-1][1]

data[2,:] = (data[2,:] - context.position_ratio[-1][2]) / context.shape_ratio[-1][2]

data[3,:] = (data[3,:] - context.position_ratio[-1][3]) / context.shape_ratio[-1][3]

return data

# blacklist is a necessity

def filter_blacklist(context, stock_list):

return [ticker for ticker in stock_list if ticker not in context.blacklist]

def filter_stlist(stock_list):

return [ticker for ticker in stock_list if not is_st_stock(ticker)]

# use data of past 6 months to train the model and apply it for the next 3 months

def modelize(context, bar_dict):

if context.every_3_months % 3 != 0:

context.every_3_months += 1

return 0

print('-'*65)

print('------'+'{:-^59}'.format('modelizing'))

context.position_ratio = []

context.shape_ratio = []

context.data = []

context.net = []

context.list = []

templist = list(get_fundamentals(query(fundamentals.eod_derivative_indicator.market_cap)

.order_by(fundamentals.eod_derivative_indicator.market_cap.asc())

.limit(context.num*5)).columns)

context.list = filter_blacklist(context, filter_stlist(templist))[:context.num]

names = []

scores = []

for ticker in context.list:

names.append('{:<11}'.format(ticker))

data = load(context, ticker)

trainX = data[:,:-1].T

trainY = data[0,1:].T

try:

net, mse = train(context, trainX, trainY)

except:

context.blacklist.append(ticker)

context.mflag = 0

return 0

context.data.append(data)

context.net.append(net)

scores.append('{:<11}'.format(str(mse)[:6]))

if np.isnan(mse):

context.blacklist.append(ticker)

context.mflag = 0

return 0

context.pct = [0] * context.num

print('------'+'{:-^59}'.format('finished'))

print('-'*65)

print(' nm | '+' '.join(names))

print('mse | '+' '.join(scores))

context.mflag = 1 # flag that we've already modelized at least once

context.tflag = 0

context.every_3_months += 1

context.mv = dict(zip(context.list, [0]*len(context.list)))

def mkt_panic():

# market alert

mkt = history_bars('000001.XSHG', 3, '1d', 'close')

panic = (mkt[-1]/mkt[-2] < 0.97 and mkt[-2]/mkt[-3] < 0.97) or mkt[-1]/mkt[-2] < 0.95

if panic:

print('!!!!!!'+'{:!^59}'.format('panic'))

return 1

return 0

# set alert range [a,b]

def trade(context,bar_dict):

while context.mflag == 0: modelize(context, bar_dict)

trash_bin = [ticker for ticker in context.portfolio.positions if ticker not in context.list]

for ticker in trash_bin: order_target_percent(ticker, 0)

actual_close = []

actual_high = []

actual_low = []

actual_vol = []

actual_open = []

actual_data = []

predict_close = []

for i in range(context.num):

actual_close.append((history_bars(context.list[i], 1,'1d','close')[0] - context.position_ratio[i][0]) / context.shape_ratio[i][0])

actual_high.append((history_bars(context.list[i], 1,'1d','high')[0] - context.position_ratio[i][1]) / context.shape_ratio[i][1])

actual_low.append((history_bars(context.list[i], 1,'1d','low')[0] - context.position_ratio[i][2]) / context.shape_ratio[i][2])

actual_vol.append((history_bars(context.list[i], 1,'1d','volume')[0] - context.position_ratio[i][3]) / context.shape_ratio[i][3])

actual_open.append((history_bars(context.list[i], 1,'1m','close')[0] - context.position_ratio[i][0]) / context.shape_ratio[i][0])

actual_data.append([actual_close[i],actual_high[i],actual_low[i],actual_vol[i]])

predict_close.append(context.net[i].activate(actual_data[i])[0])

if context.tflag == 0:

context.temp_pc = predict_close

r = [float((pc*shape_ratio[0]+position_ratio[0]) / (ao*shape_ratio[0]+position_ratio[0]) - 1) for pc, ao, shape_ratio, position_ratio in zip(predict_close, actual_open, context.shape_ratio, context.position_ratio)]

temp_r = [float((pc*shape_ratio[0]+position_ratio[0]) / (tpc*shape_ratio[0]+position_ratio[0]) - 1) for pc, tpc, shape_ratio, position_ratio in zip(predict_close, context.temp_pc, context.shape_ratio, context.position_ratio)]

# stop loss trick

for stock in context.portfolio.positions:

try:

mv = context.portfolio.positions[stock].market_value # Cap

if mv > context.mv[stock]: context.mv[stock] = mv # History Price Max

md = 1 - mv/context.mv[stock] # Max DD

if md > .5: order_value(stock, mv/2)

except:

pass

# The essence of this strategy

hybrid_r = [max(ri,temp_ri,ri+temp_ri) for ri, temp_ri in zip(r,temp_r)]

bad_hybrid_signal = sum([x <= 0 for x in hybrid_r])

a, b = 0.02, -0.02

panic = mkt_panic()

for i in range(context.num):

if panic or 0 < context.post_panic < 22 * context.num:

context.pct[i] = 0

context.post_panic = (1 - panic) * (context.post_panic + 1) + panic

elif hybrid_r[i] > a:

context.pct[i] = min(context.pct[i] + .5/context.num, 2/context.num)

context.post_panic = 0

elif hybrid_r[i] < b or bad_hybrid_signal > 3*context.num//5:

context.pct[i] = max(context.pct[i] - .5/context.num, 0)

context.post_panic = 0

if context.tflag == 1: print(' ac | '+' '.join(['{:<11}'.format(str(ac)[:6]) for ac in actual_close]))

print('-'*65)

print(' ao | '+' '.join(['{:<11}'.format(str(ao)[:6]) for ao in actual_open]))

print(' pc | '+' '.join(['{:<11}'.format(str(pc)[:6]) for pc in predict_close]))

print(' r | '+' '.join(['{:<11}'.format(str(ri)[:6]) for ri in hybrid_r]))

pct = sum([context.portfolio.positions[ticker].market_value for ticker in context.portfolio.positions])/(context.portfolio.market_value+context.portfolio.cash)

tot_pct = max(sum(context.pct), 1)

context.pct = list(map(lambda x: x/tot_pct, context.pct))

print(' % | '+' '.join(['{:<11}'.format(str(p)[:6]) for p in context.pct]))

plot('total position', pct * 100)

for i in range(context.num): order_target_percent(context.list[i], context.pct[i])

context.tflag = 1

context.temp_pc = predict_close

def init(context):

context.temp_pc = []

context.every_3_months = 0

context.tflag = 0

context.mflag = 0

context.mv = []

context.position_ratio = []

context.shape_ratio = []

context.num = 20

context.list = []

context.pct = [0] * context.num

context.net = []

context.data = []

context.post_panic = 0

context.blacklist = [

'000004.XSHE','000546.XSHE',

'000594.XSHE','002352.XSHE',

'300176.XSHE','300260.XSHE',

'300372.XSHE','600137.XSHG',

'600306.XSHG','600656.XSHG',

]

scheduler.run_monthly(modelize,1)

scheduler.run_daily(trade)

# do nothing before 9:00

def before_trading(context):

pass

# do not trigger minute bar activities

def handle_bar(context, bar_dict):

pass